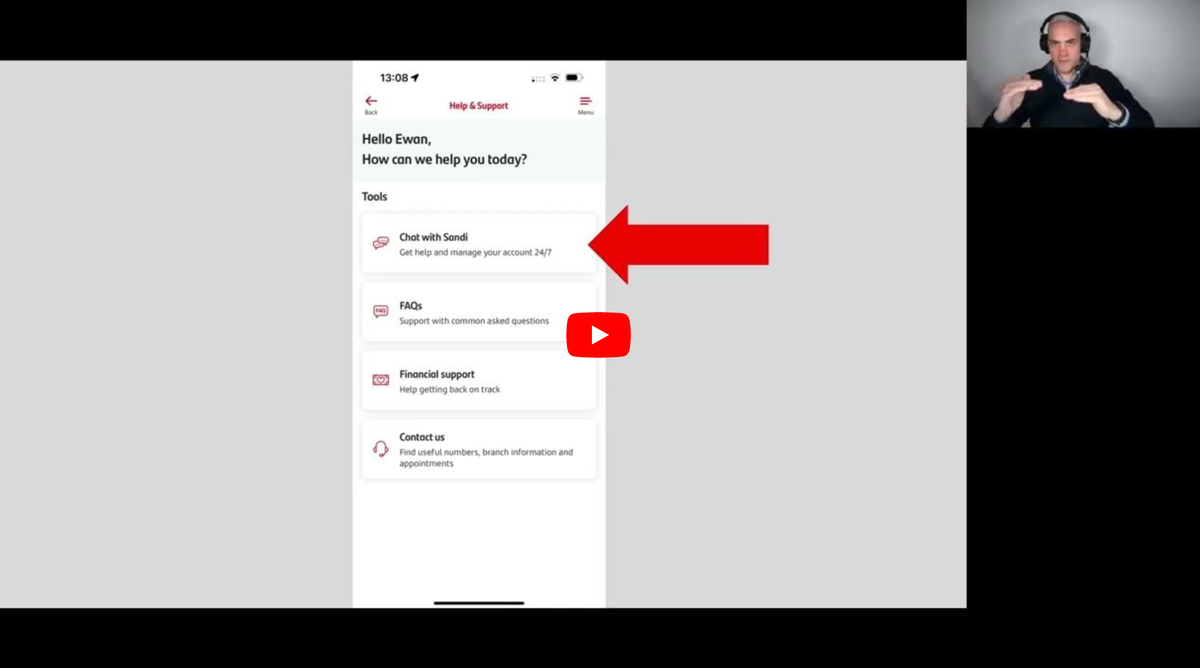

Video walkthrough: Santander UK's Sandi chatbot is best-in-class

Earlier this week I published a screenshot walkthrough showing how the Santander UK chatbot, "Sandi", handles a simple debit card replacement request.

It blows the other UK banks I've looked at out of the water. It really is night-and-day difference.

Sandi just does it.

Here's the video walkthrough:

Summary

In this episode, Ewan reviews the chatbot capabilities of Santander UK. He compares it to other banks and highlights the strengths and weaknesses of their chatbot systems. Ewan is impressed with Santander's chatbot, called Sandi, as it efficiently handles a simple task of replacing a damaged debit card. He praises Santander for its user-friendly interface, quick response time, and seamless process. Ewan encourages other banks, such as NatWest and Lloyds, to improve their chatbot capabilities to match Santander's level of efficiency.

Takeaways

- Santander UK's chatbot, Sandi, provides a best-in-class user experience for replacing a damaged debit card.

- Santander's chatbot is efficient, user-friendly, and provides quick responses.

- Other banks, such as NatWest and Lloyds, have room for improvement in their chatbot capabilities.

- Ewan MacLeod encourages banks to prioritise user experience and streamline their chatbot processes.

Chapters

- 00:00 Introduction to Chatbots and Santander UK

- 02:17 Comparing Chatbot Capabilities: Santander vs. NatWest vs. Lloyds

- 06:09 The Importance of Simplicity in Chatbot Interactions

- 09:03 Santander UK's Best-in-Class Chatbot Experience

- 10:31 Encouraging Banks to Improve Chatbot Capabilities

Sound Bites

- "This is best in class. Absolutely best in class."

- "NatWest [and Lloyds/HSBC], read this and weep."

- "Santander, thank you very much for making such a great capability."