Tifin's Conversational AI, Magnifi, now provides intelligence on $2 Billion of self-directed assets

Tifin is doing some rather interesting things in the Conversational AI space.

Here's the boilerplate overview of the company from a recent release:

TIFIN is an AI and innovation platform for better wealth outcomes. Founded by Dr. Vinay Nair, TIFIN creates and operates new companies that apply data science, AI, and technology to address frictions in wealth and asset management. TIFIN’s companies have included 55ip (sold to JP Morgan), Paralel and currently include Magnifi, TIFIN Wealth, TIFIN Give, TIFIN AG, TIFIN AMP, Sage, Helix, and TIFIN @Work. TIFIN has been backed by JP Morgan, Morningstar, Hamilton Lane, Franklin Templeton, SEI, Motive Partners, and Broadridge among others.

So they're one to watch.

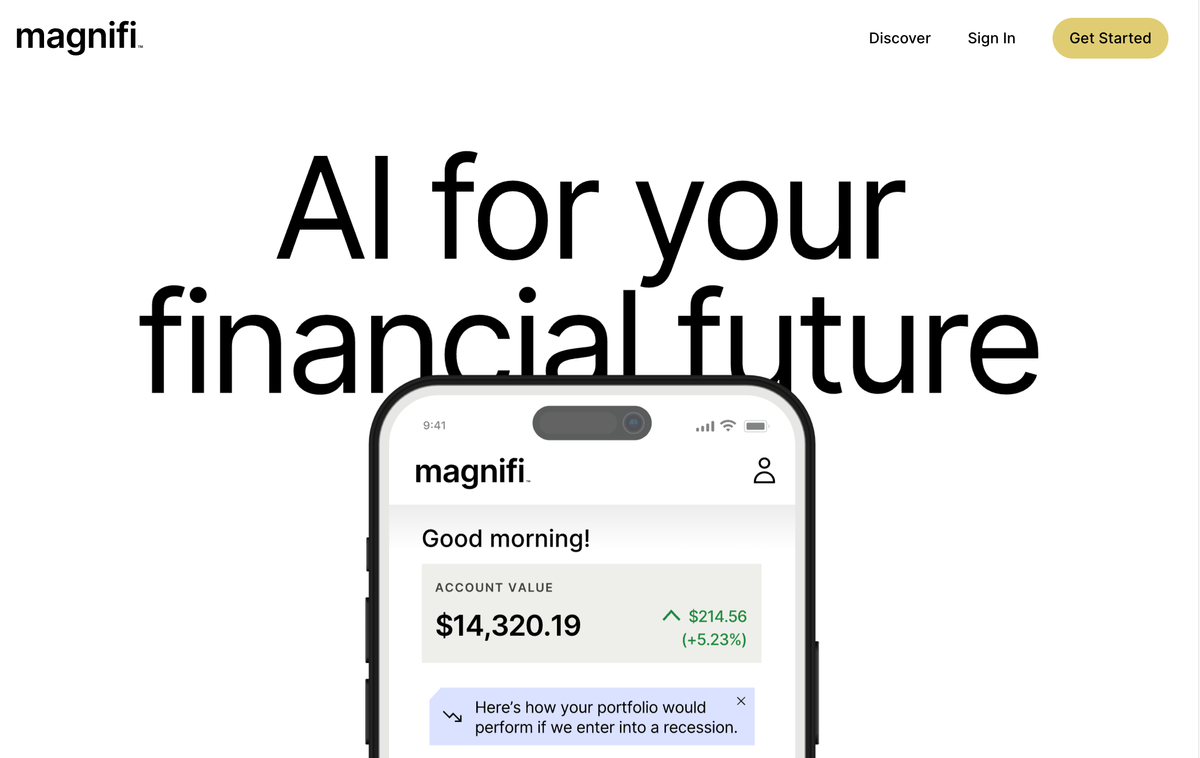

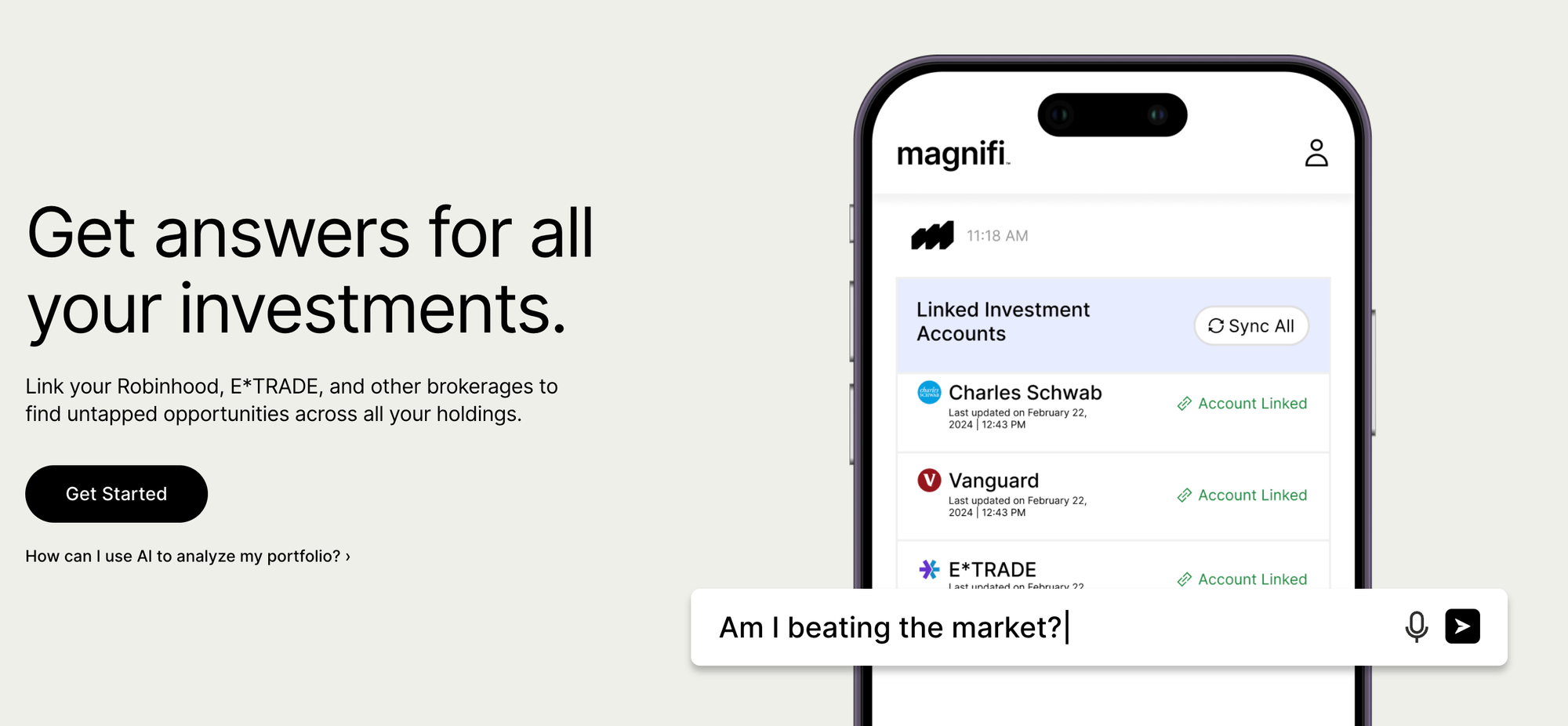

I wanted to document the fact that their Magnifi offering is now providing investment intelligence on over $2 Billion of self-directed assets. That number is only going to increase, as I'd imagine there are a lot of people out there who'd like to benefit from this kind of service.

You've got your assets sitting across a few brokerage and savings/investment accounts, right? Who's helping you with that? You might have a human adviser – and, if those total assets are pretty huge, you might be paying the adviser a fat fee every year to 'look at it'. An alternative is to use Magnifi.

The Tifin team are running fast with development, as last week's release highlights:

What started in 2023 with the ability to identify hidden risks across a customer’s investment accounts has grown to include end-to-end performance monitoring, personalized market alerts, portfolio health checks, and buy/sell impact analysis — all available in a generative AI interface.

You can even trade through the platform – and Magnifi does not generate any revenue from commissions or order flows. Instead, you just pay the subscription fee (around $11 per month).

Very interesting.

I know many banks and wealth management companies who have been flirting with the concept of some kind of automated / conversational AI wealth management offering. There are some hard numbers from Tifin. $2B of wealth is being managed this way. How long before that is $20B? $200B?

Read the full release here and check out the Magnifi service directly at https://magnifi.com/ or search in the app stores for it.

The Tifin founder is Anil Arora:

And if you're looking to have a commercial conversation with them, I reckon Rob Pettman, Tifin's Chief Revenue Officer, might be a good first contact: