Thyme: Meetings intelligence for Financial Advisors

I caught the Thyme announcement from the Y-Combinator news feed and thought it deserved a note here on Conversational AI News.

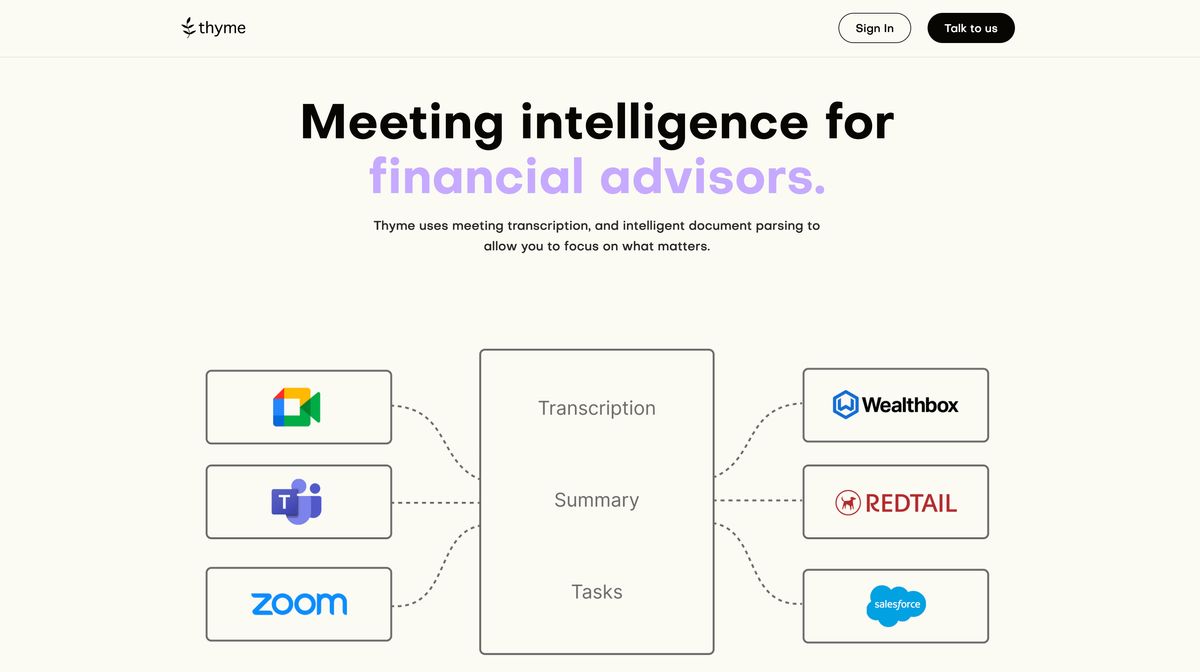

Here's the super-quick summary:

Thyme enables financial advisors to run 10x better meetings. We cover meeting prep, transcription, summarization, CRM syncing, and document parsing. Please introduce us to any financial advisor in your network!

A lot of financial services clients ask me for examples of how "AI" can help in a financial advice setting. I have recently been pointing to the Pluto acquisition by Robinhood as just one example.

With Thyme, here's another.

The concept with Thyme isn't just about Conversational AI of course. It's a mashup of several technology capabilities, placed into one compelling offering which, I would imagine, will only improve as the company continues to iterate.

For example:

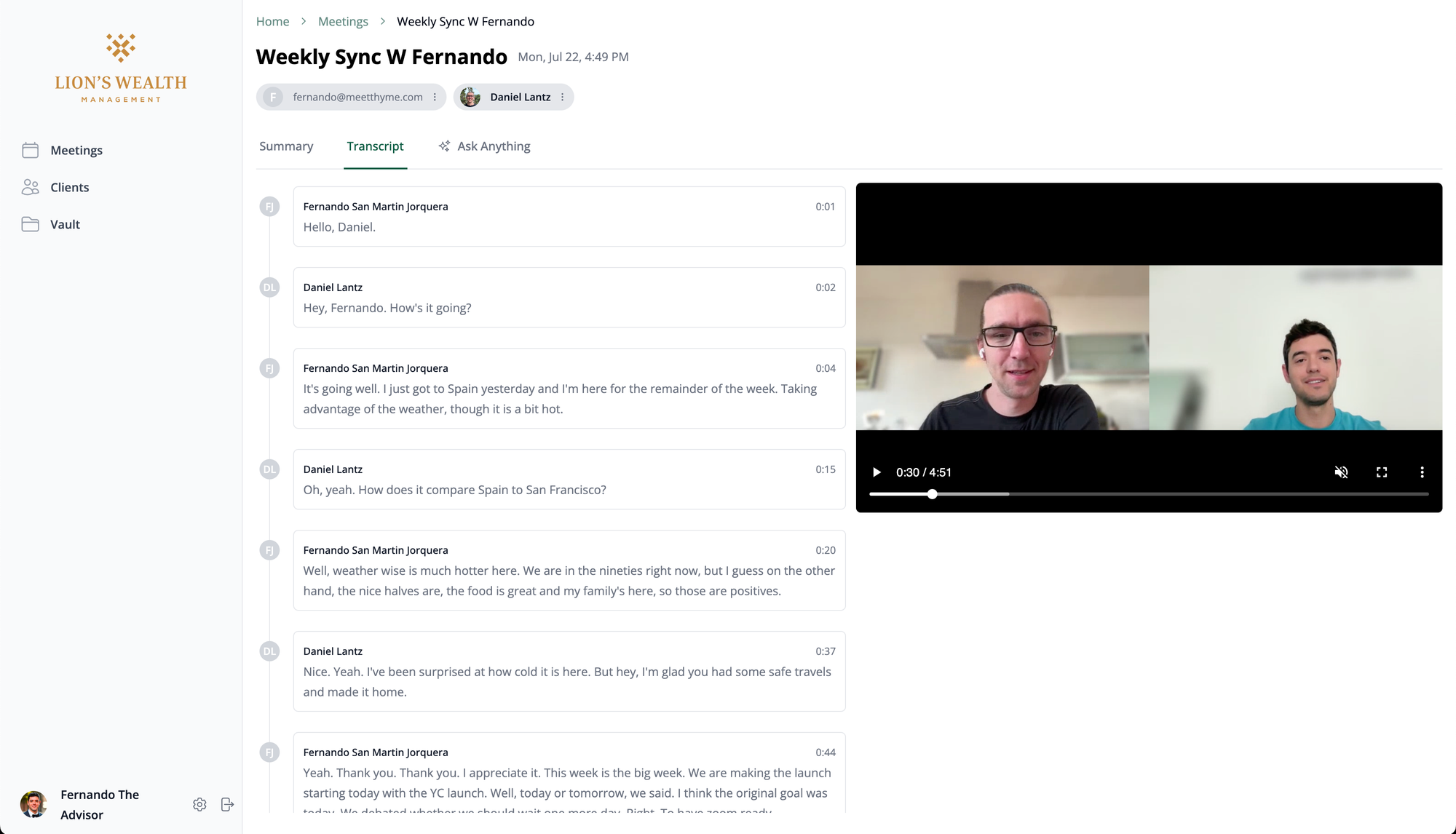

Using our app, the advisor can see their upcoming meetings, for which they can prepare by viewing a holistic profile about the client and even asking natural language questions. Once in the meeting, our app uses state-of-the-art AI technology to transcribe, summarize, generate action items, and draft follow-up emails.

Here's a sample screenshot:

This is what your Wealth advisors need.

You can build this yourself, as a financial institution.

I'm not sure you should though.

I think you should probably be buying it as a service.

Yes, it's possible some institutions might like to own the whole stack – and make sure the integrated service is even better for their Wealth or financial advisors.

If you've got a corporate venture capital capability, you might consider to carefully follow companies such as Thyme. Or take a stake now, watch it carefully, help them grow, expand, develop and then buy it!

How about integrations with Thyme?

Finally, our powerful integrations with the rest of the advisors’ tech stack also allow us to initiate workflows and send tasks and notes to other systems. Any financial documents submitted by the client are parsed and integrated into their profile.

The next question everyone – and I do mean everyone – in financial services is going to ask, especially when it comes to the bigger institutions, is data ownership, compliance and management thereof.

I encourage the founders to say even more about this on their website. Here's what they've got currently:

I'd suggest expanding this to say more about data residency, ownership policies, segmentation (i.e. one customer can't see the other customer's data/documents) and geographic questions (e.g. Hosted on Azure in the following geographic zones...). That's an easy fix though.

I can imagine this becoming a highly compelling if not business critical tool for financial advisers - both in the context of independent advisers and also those working in bigger corporates.

Good luck to the founding team!

You can find Thyme on LinkedIn here.

Reach out to the two founders via LinkedIn here: