Santander UK's Sandi chatbot blows HSBC, NatWest & Lloyds away

I recently wrote on FinTech Profile that I was deeply impressed with the way in which Santander UK had launched their mobile revamp.

During that review I noted that the team had deployed "Sandi", their Chatbot (or conversational AI). I resolved to check it out later on.

Today I did.

And goodness me, I'm impressed.

Here's why: It.just.works.

I'm not sure on the technology behind it, but whatever the Santander Conversational AI team have been doing, it works.

Now, I should qualify this overview by saying I only tested one key use case, but it's a use case that totally stumps NatWest, Lloyds and HSBC at the moment.

Their answers to my simple test use case required me to do a lot of work.

Whilst I eventually got the job done, it really should be straight-through.

Best in class - which I often see from Nordic banks - hasn't really translated to UK banks yet, many of which are still offering 1990s technology dressed up with some fancy visuals.

But today, I got best-in-class from Santander UK.

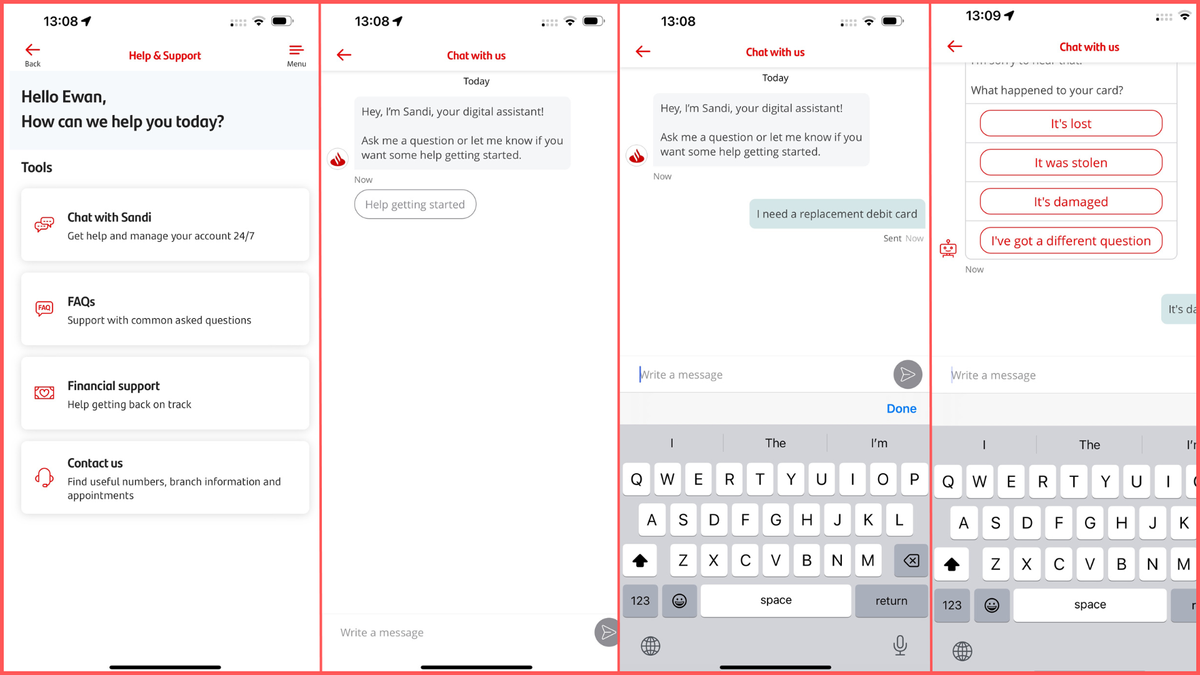

Here, then, is the walk through.

The use case I like to use when checking out financial services Conversational AI is around debit card replacement. It's easy, but it's also fraught with process nightmare - because you do need to check if the replacement has been lost or stolen first. That can generate a whole host of other, very serious issues. So I like to see how the bank handles that Q&A approach, then I like to see how they handle the "it's damaged" prompt (i.e. the card is damaged, so just get it replaced).

And it should be that simple. Tap, tap, type, done.

There is no need to qualify further. If the customer says their debit card is 'damaged', just get them a new one as quickly as possible.

That's not what the leading UK giants are doing. You have to do all the work for yourself. Here's my write-up showing how it works for HSBC UK. Here's my similar write up for the Lloyds and NatWest chatbot head-to-head.

Let's get to Santander UK then:

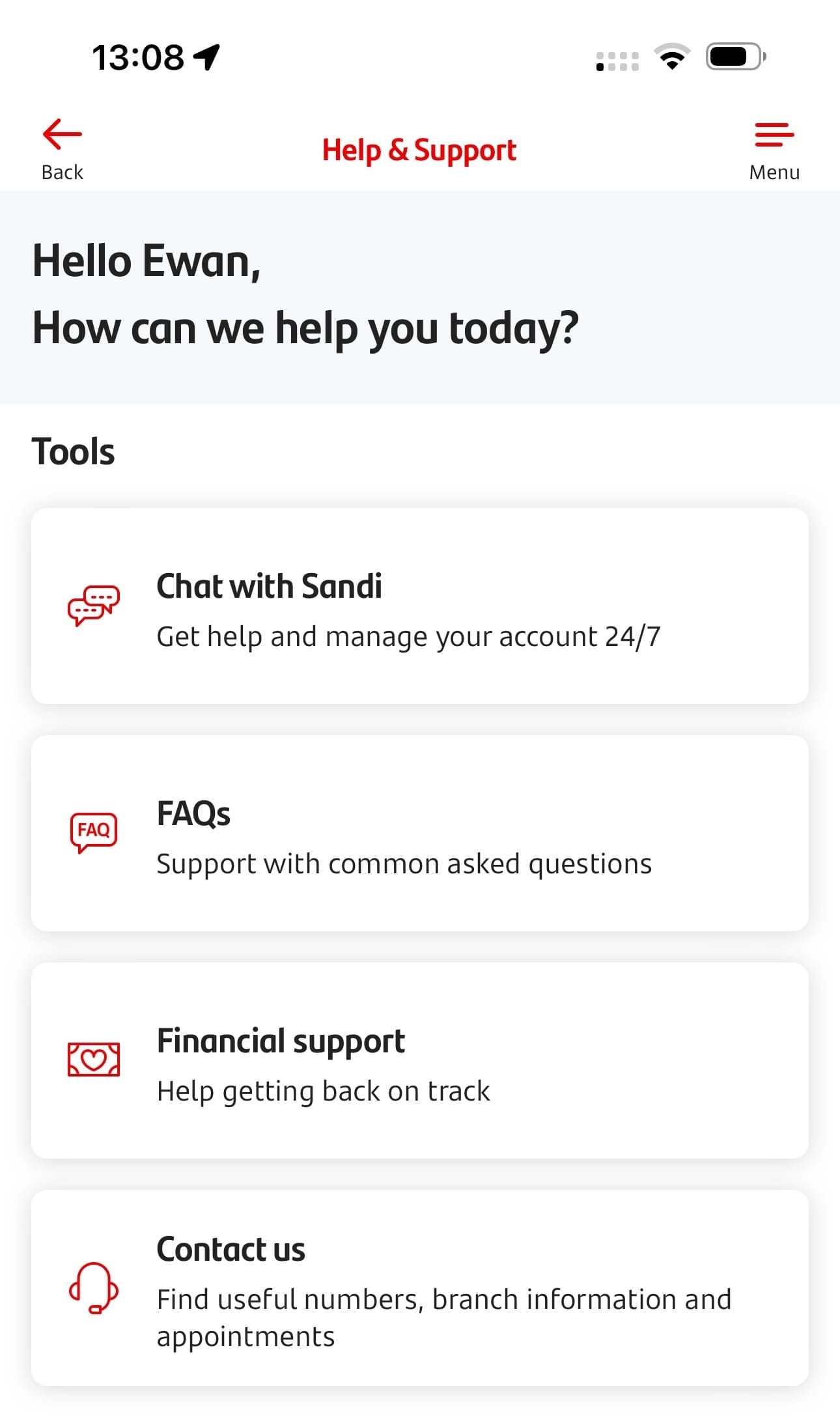

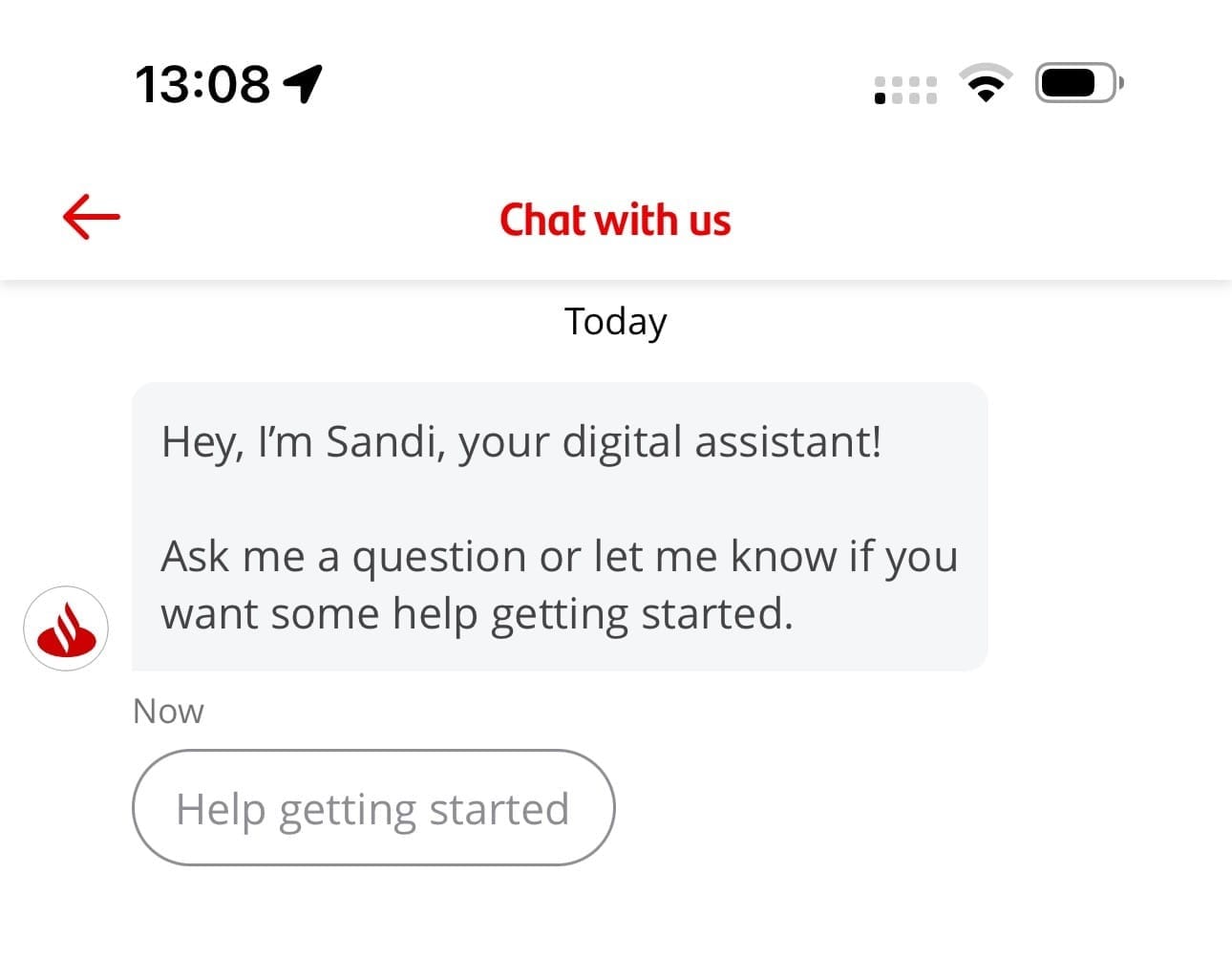

Above we see the main welcome screen when I tap on help from the homepage. Note that Chat with Sandi is presented as the first option, FAQ second, financial support third and right at the bottom, Contact us. So already the focus is squarely placed on putting the chatbot as the primary entry point for any help.

Right, let's tap on Chat with Sandi.

Above, we see the welcome message.

Santander has decided to call Sandi their digital assistant. This is in sharp contrast to how the other UK banks are approaching things. Lloyds throws all sorts of warnings prior to talking with their chatbot – Lloyds even tell customers to keep their queries below 15 words.

Santander doesn't bother with that nonsense. As you can see, we're straight in. We're prompted with a polite question. There's a text box for me to enter my query, or, if I'm not sure, I am already being presented with a Help getting started option.

In this example, I haven't bothered with this. I wanted to see how Sandi handled my simple query – the same I've posed to HSBC, NatWest and Lloyds recently.

So let's get to it.

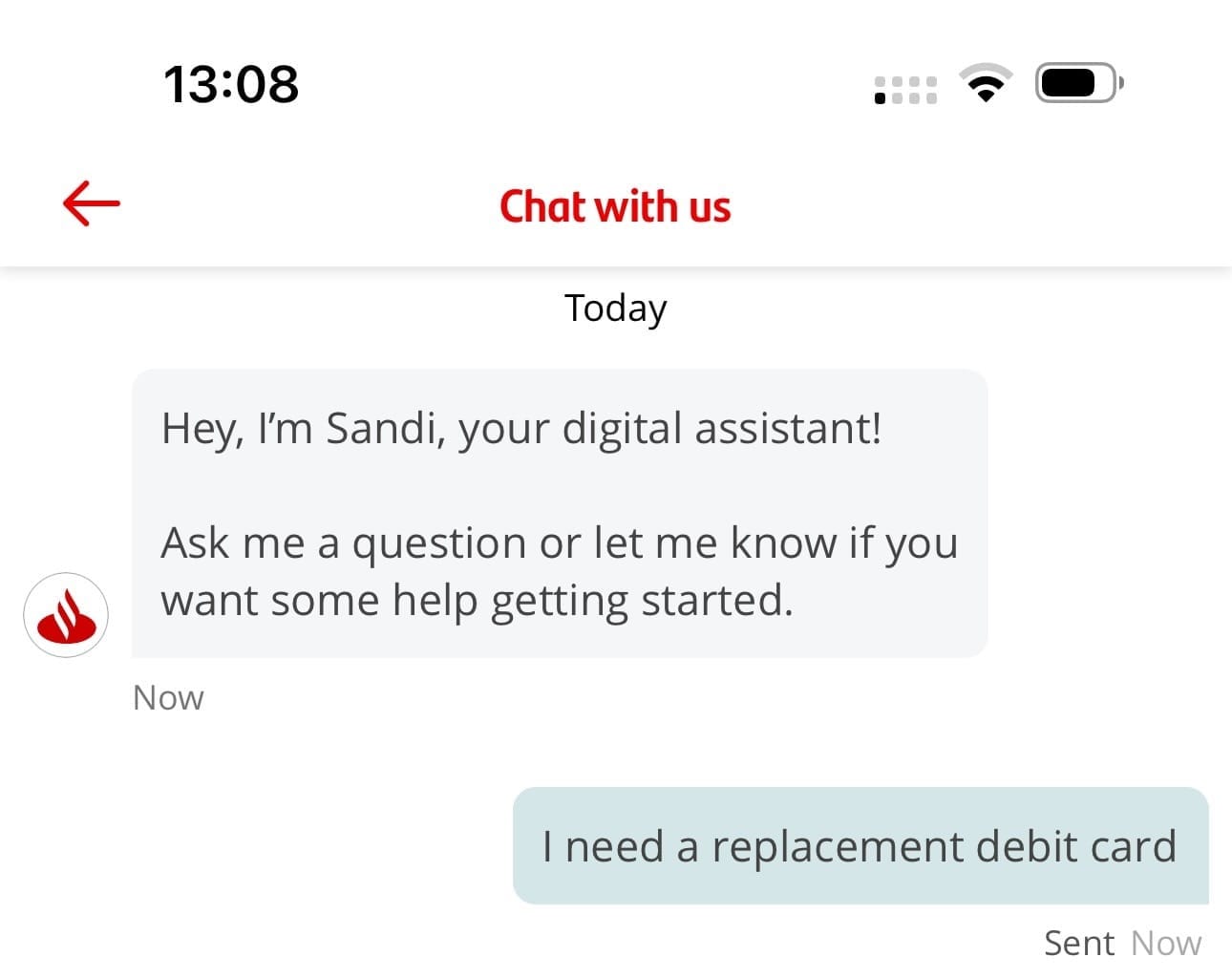

So above, you can see I've typed in the phrase. A response was immediate. No waiting.

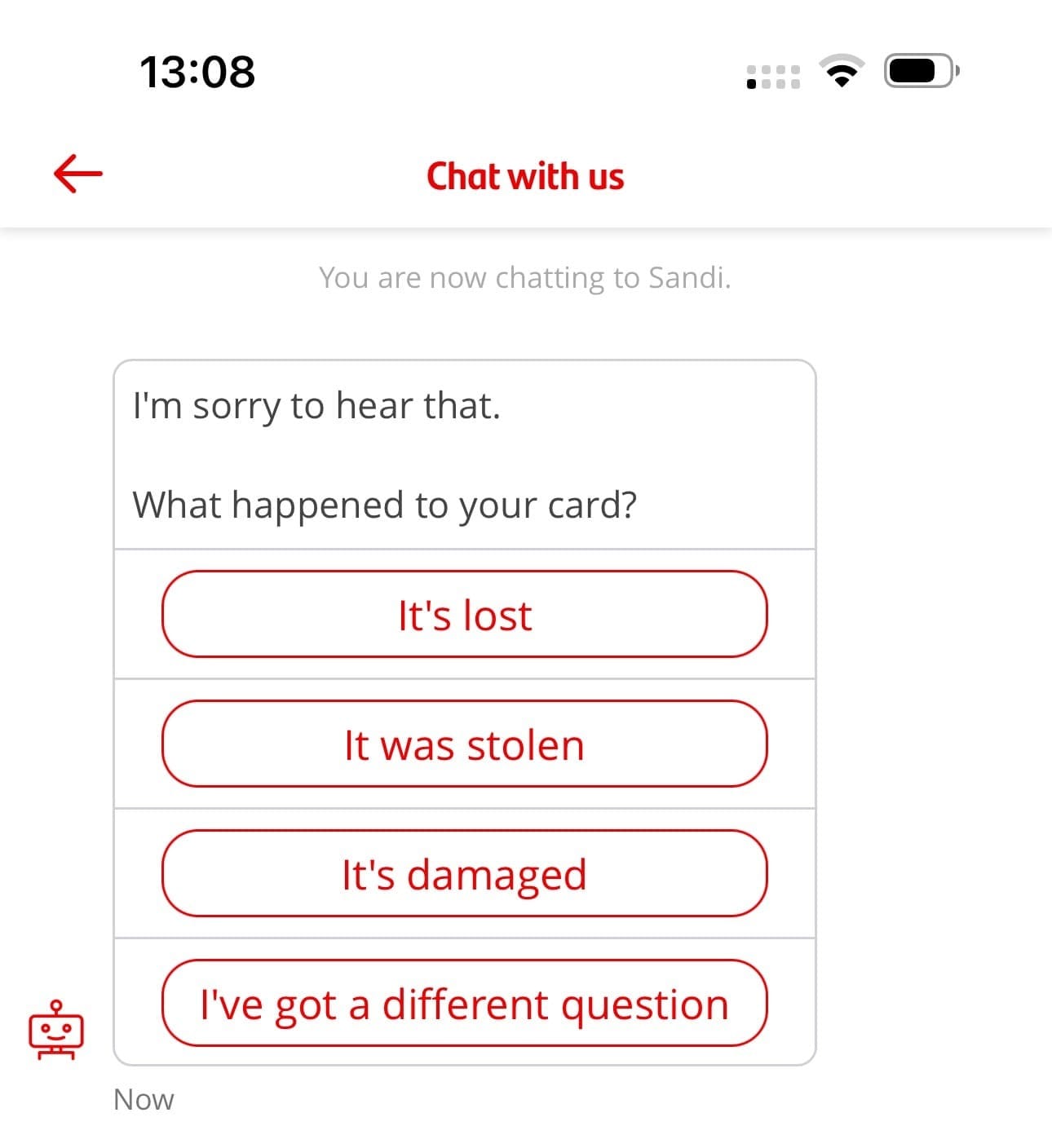

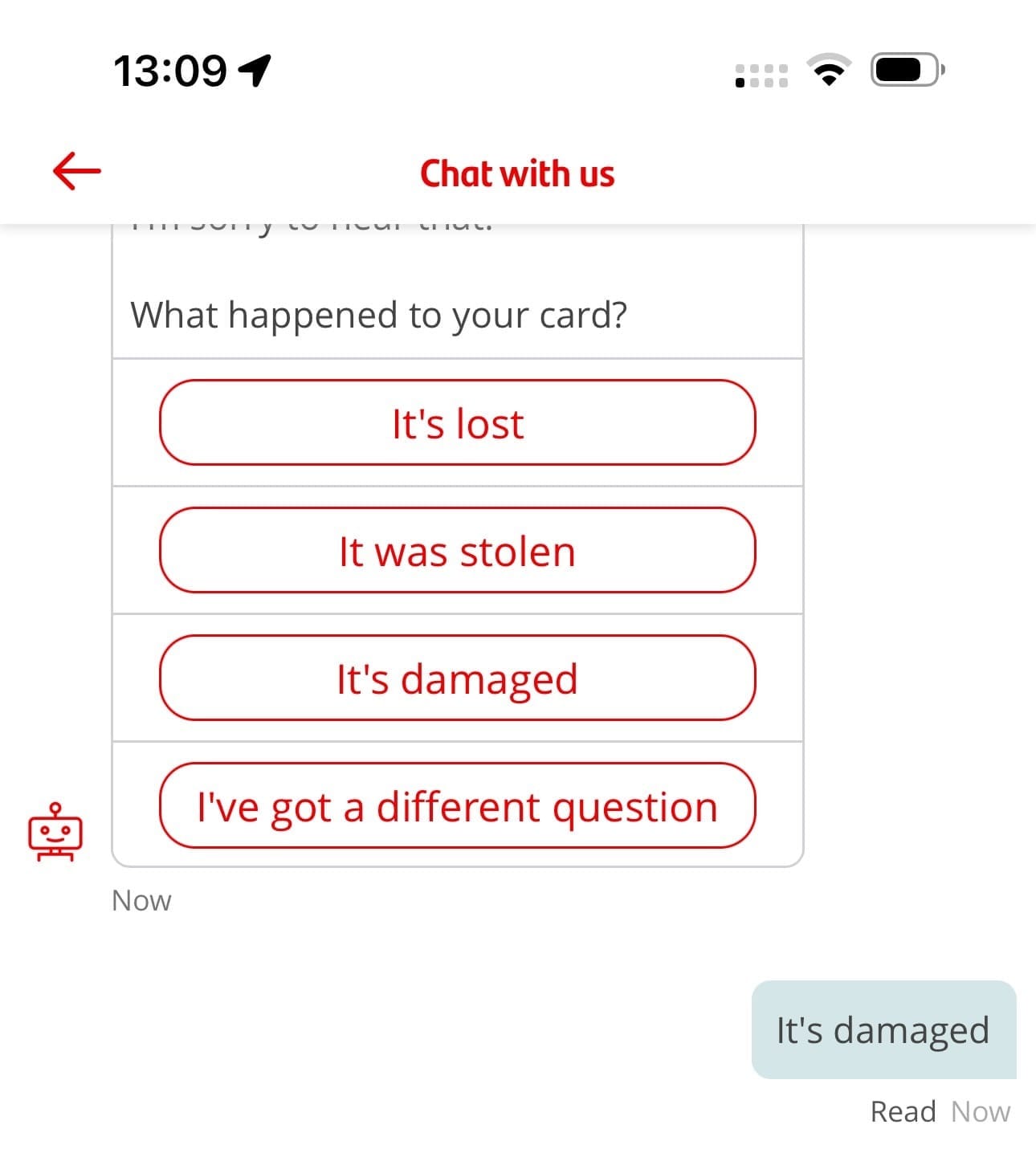

Above, you can see my intent is instantly recognised. There's a basic platitude ("I'm sorry to hear that") but we don't need any more empathy, just a fix, so I'm pleased Sandi is getting to the point. You can see the default options for me to choose. As always, I'll select "It's damaged" as this is the simplest journey for every Conversational AI.

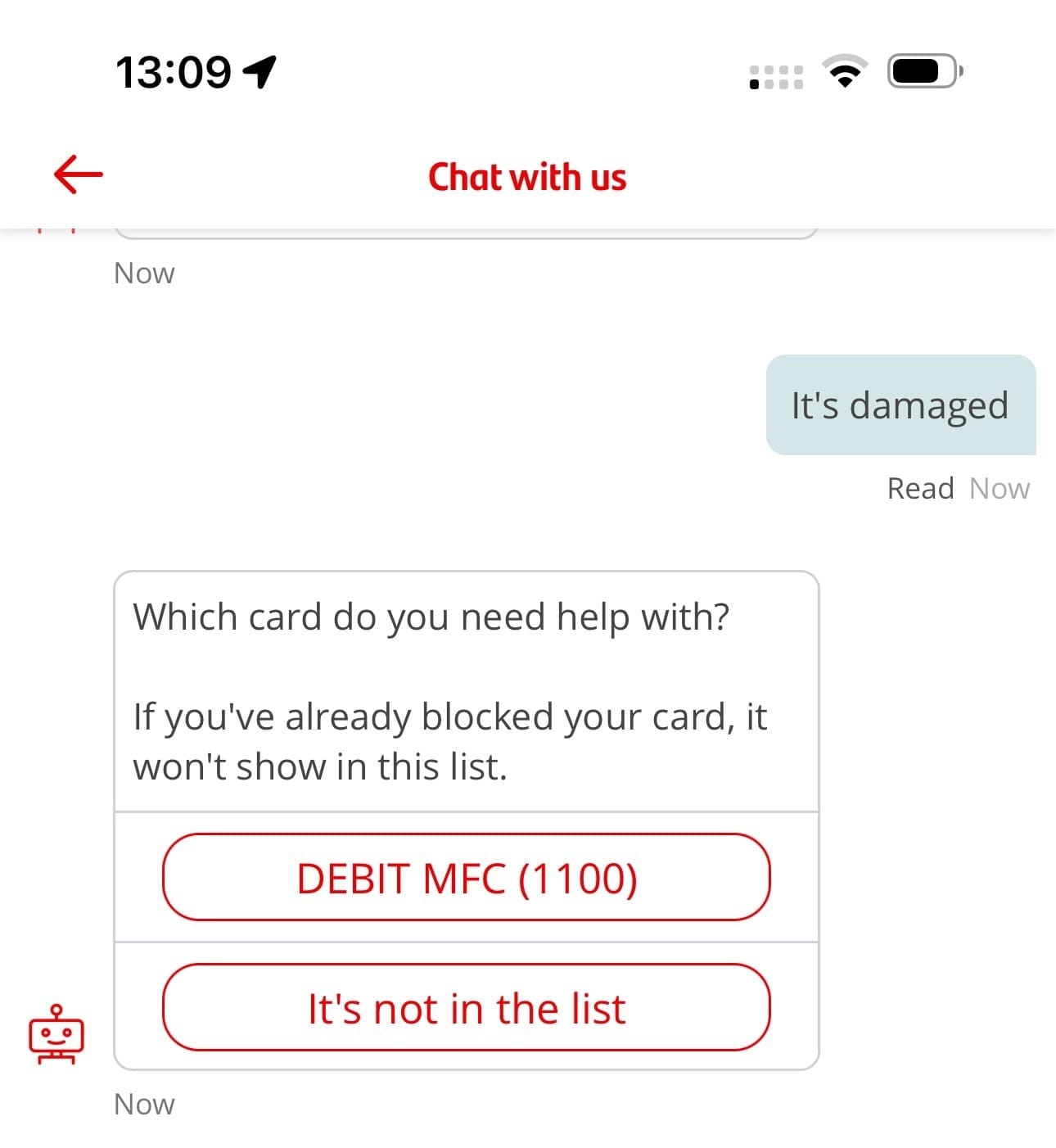

Above you can see I've tapped "It's damaged".

Above shows the next step – Sandi has to identify the card, just in case I have multiple debit cards. Note that like other banks, Sandi has connected to some core systems to check the debit cards assigned to my account. Good.

If I'm being critical – I'm splitting hairs – I would like the product name to be a little simpler. "DEBIT MFC" doesn't mean much to a consumer. I presume this means "Debit Multi Function Card" or similar. I'd rather this was just "Debit card".

The brackets "(1100)" corresponds to the last 4 digits of the card, by the way.

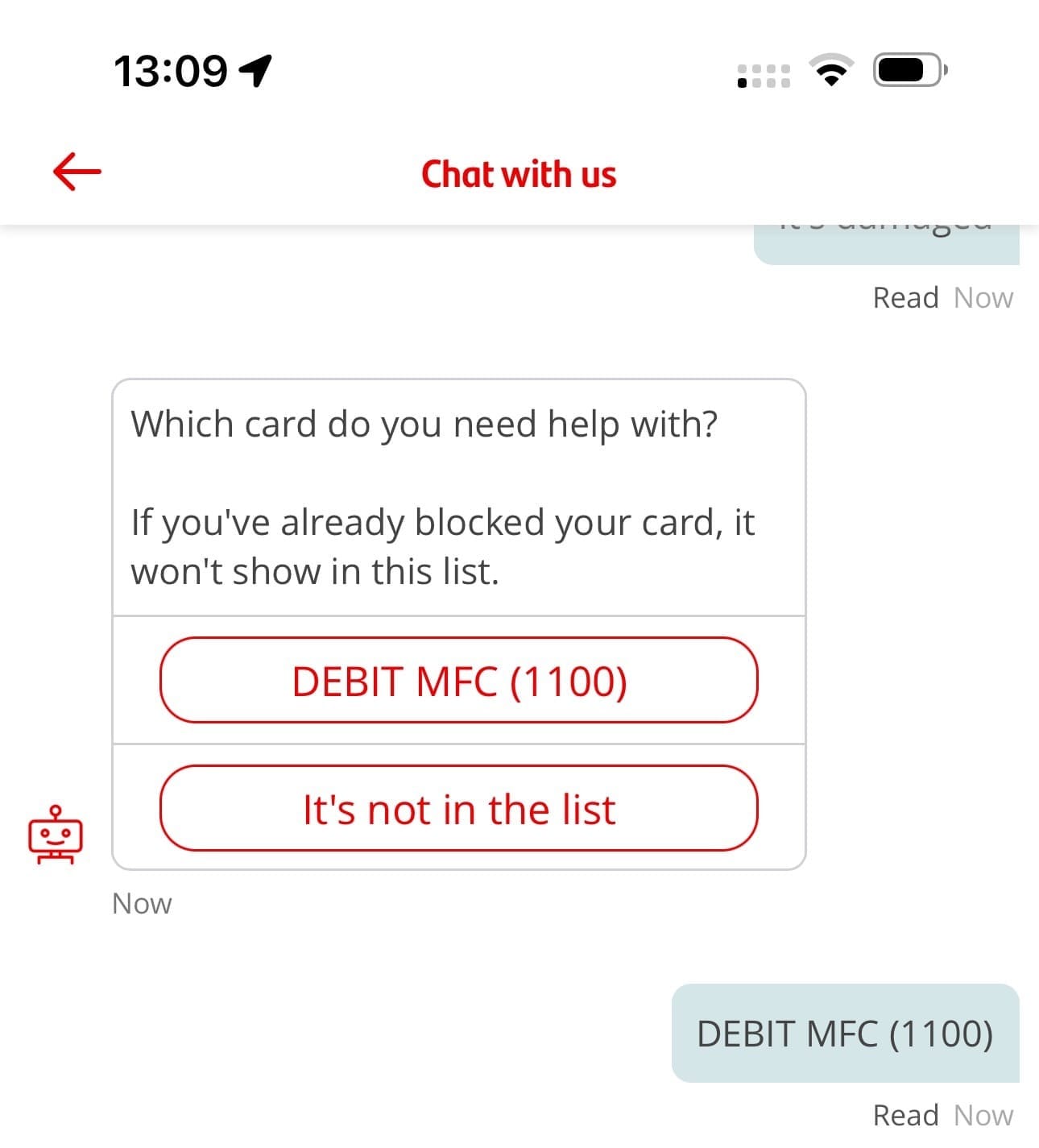

Above you can see I've selected the card.

So far, so good.

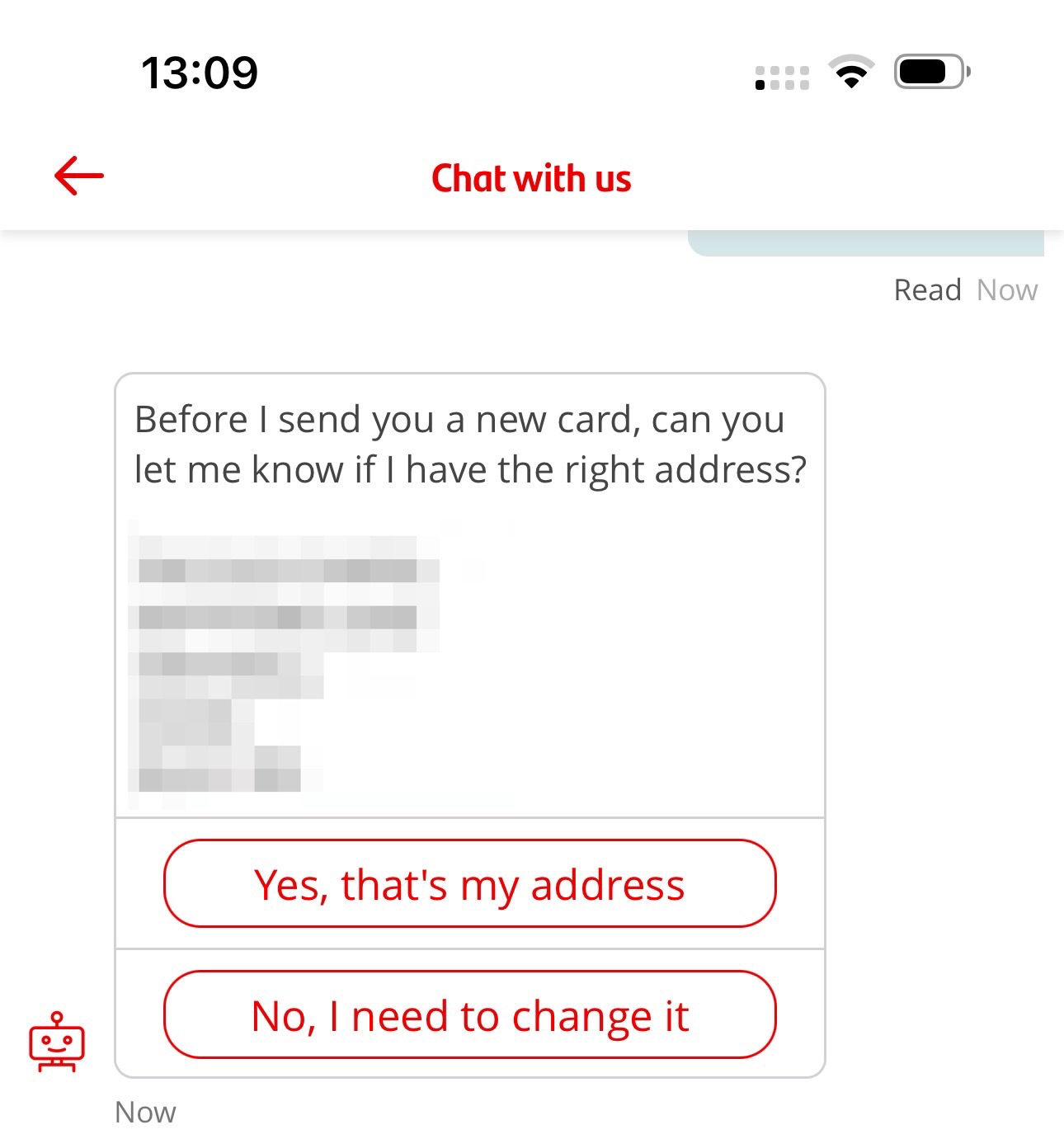

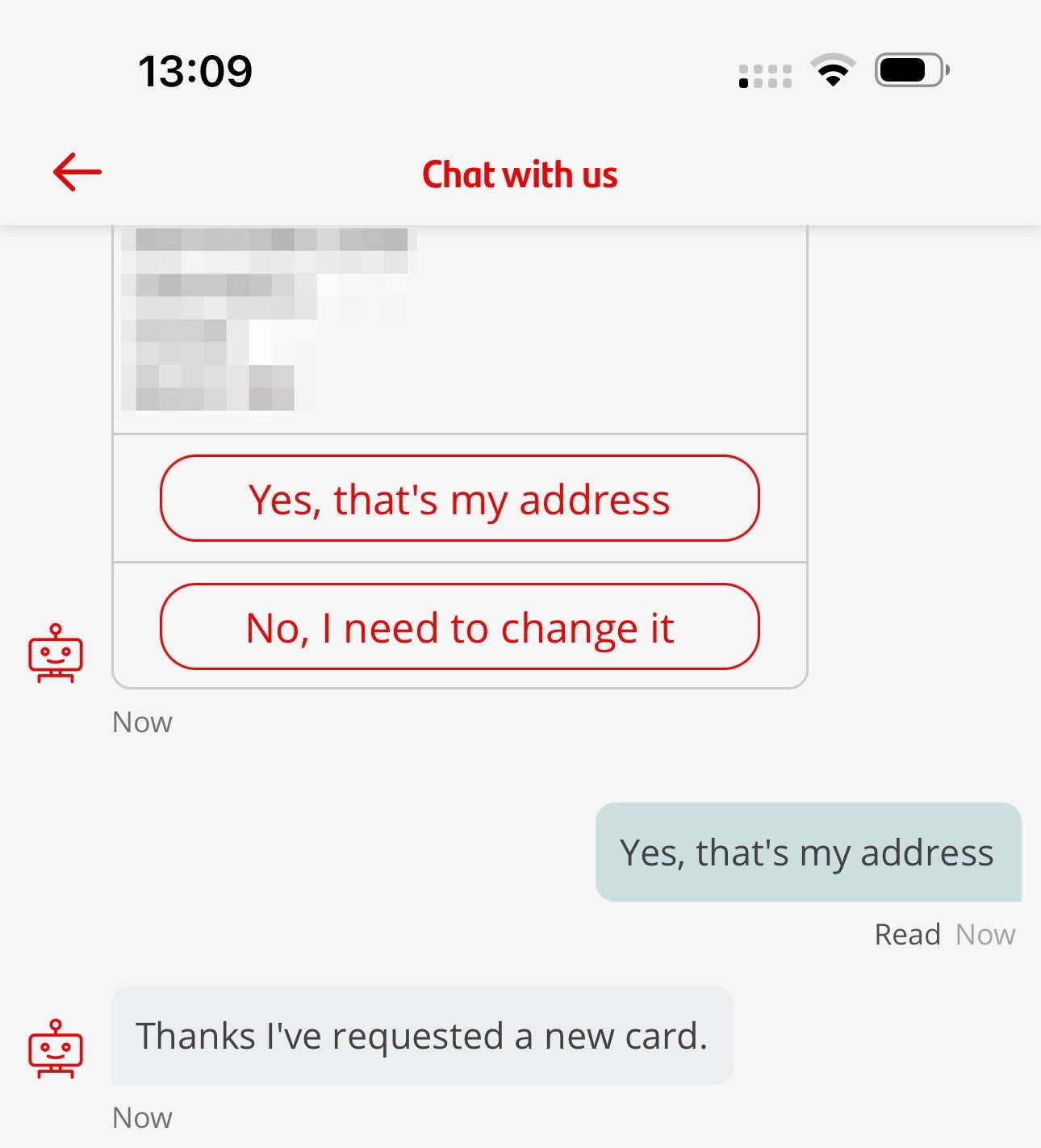

Above, is yet another core bank call to get my address. It's important that the system checks it's about to send the replacement to the correct address.

So far, so good.

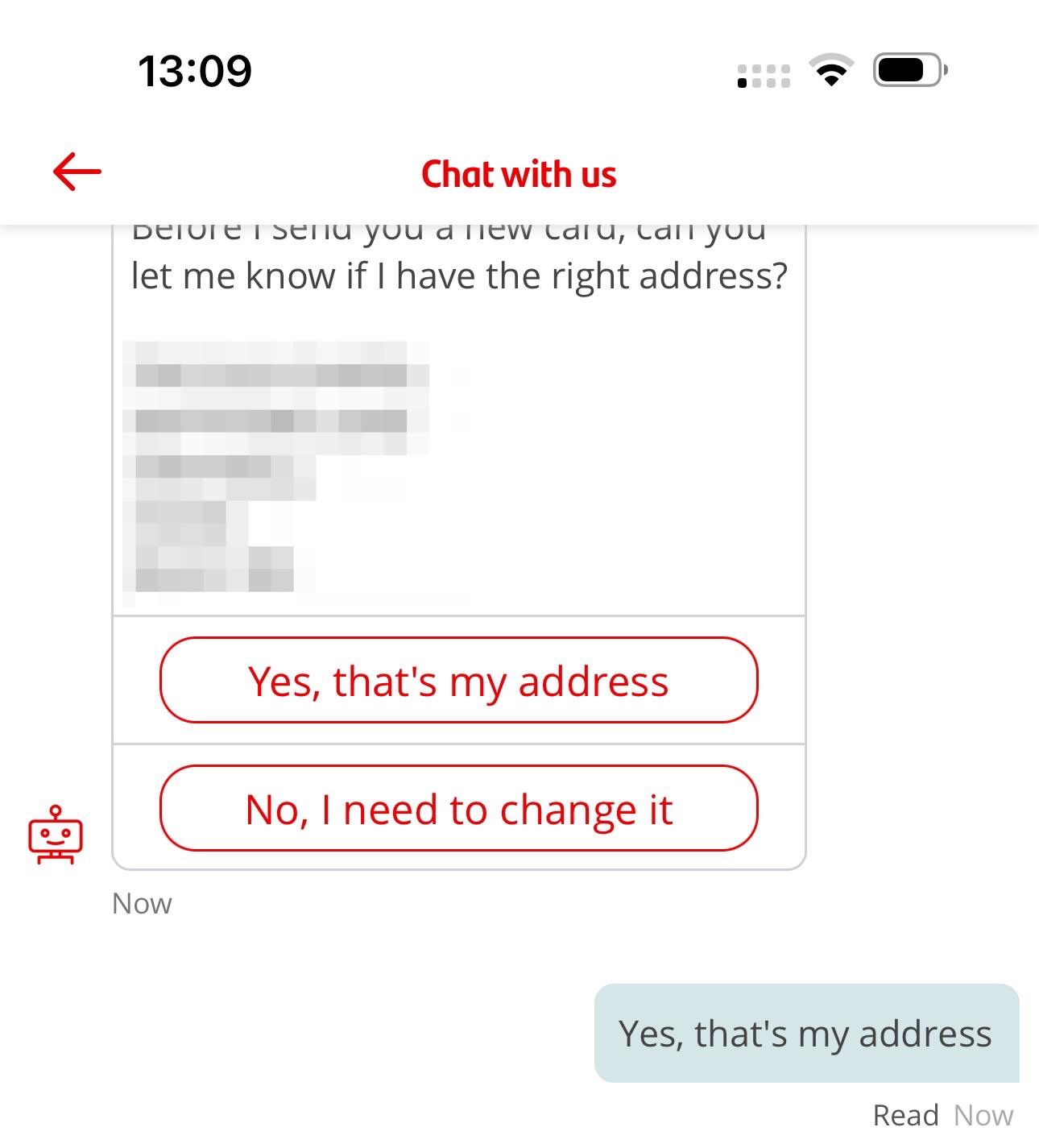

Above, I select "Yes, that's my address".

Great.

Now...

Theoretically there should be no further messing around. This, as far as I am concerned, is the transaction over, right? I've told you - the bank - it's damaged. I obviously want a replacement. Fix it. Next.

I don't want any more jazz. I don't want any more steps. I don't want to go hunting around your app like Lloyds makes me do. I don't want to mess about filling in my date of birth and trying to find the last 4 digits of my card.

It should just work.

Guess what?

Above, see the immediate response.

I was floored.

You what?

Sorry, you've done it?

What?

I had to do a double take when I was going through this stage.

I couldn't believe it.

A UK bank has made it happen. No messing around. No histrionics. No throwing me into a secure browser for more form filling.

Sandi just says "Thanks I've requested a new card".

Done.

Deeply impressive.

Now, dear reader, the fact that I am impressed by this shows you how bad things actually are when it comes to 'best in class' with many Conversational AI interfaces.

So I say: Very well done Santander UK. Kudos to the team. They have clearly spent the time to work through the best possible experience for the customer.

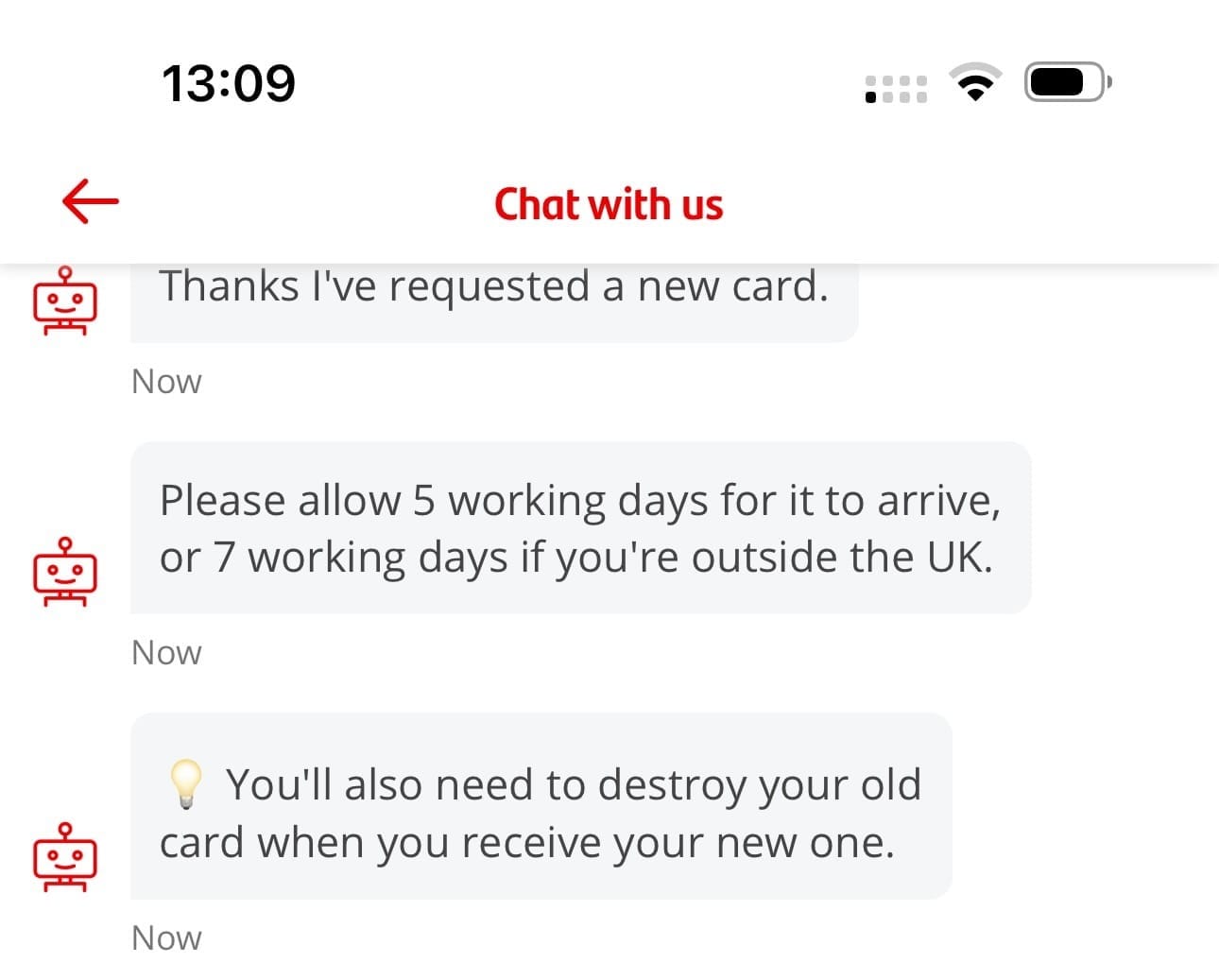

Above, for completeness, here are the prompts that follow, adding additional context for me.

Then...

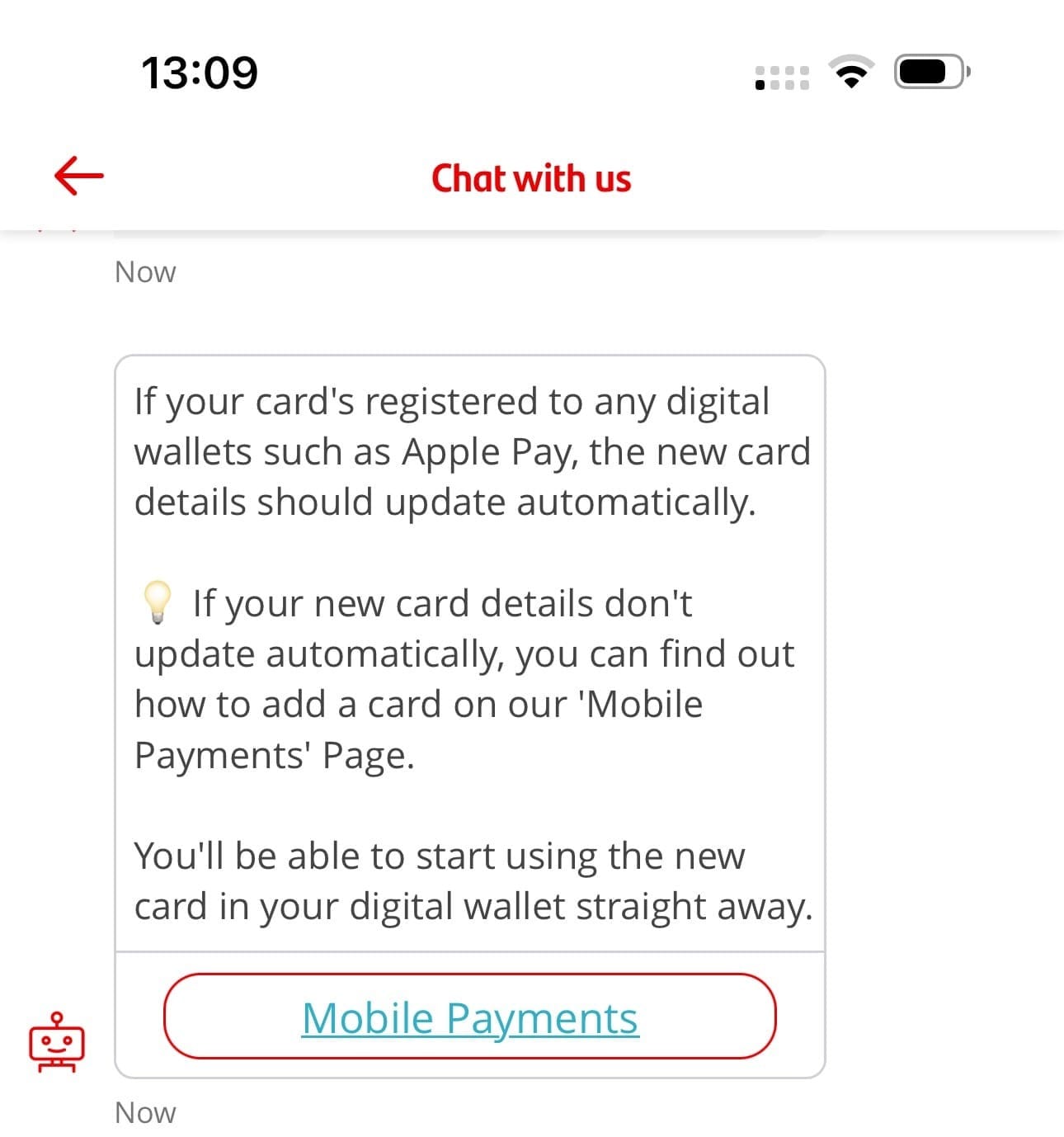

Above, the final prompt in the process is around Apple Pay - and Sandi is presenting me an in-app deep-link to go and fix this should I wish to.

So, let me take a step back for a moment.

This is deeply impressive Santander UK.

I'm sure many will be wondering why I'm so surprised - after all, this seems like quite an easy step, right?

Go and see how NatWest, Lloyds and HSBC do it. I've documented the screens in detail for their processes and they're nowhere near as good. Sandi is on a different level.

That's why I'm so surprised. I'm really pleased that the Santander team is leading the way here.

I started my journey with Sandi at 13:08.

I finished at 13:09.

It can't have been more than maybe 30 seconds. I only had to type once. Everything else was simply tapping to confirm.

So, for this use case: Best in class, Santander. Thank you.

Now then, I should highlight there's a lot more to Conversational AI interfaces than just one simple use case.

For the purists reading, I like to use this simple use case as an initial indicator for how well banks (in this case, it's different for insurance, for example) have implemented their Chatbot or Conversational AI capabilities.

It's generally instructive because it's so simple – as Santander UK illustrates. If you go and check what the other banks are doing in the same market, you'll see there's a lot more engineering needed.

For those Nordic FS players reading, I know. I know. This looks like childs play.

I should also nod to some of the North American FS players who will also think this is ultra simple.

Some banks are incredibly advanced with their Conversational AI. Some I work with have 70+ core integrations meaning they can do a lot more than just order a replacement debit card!

So if you're sitting there with your arms folded saying, "So what??" at the screen, I know. I know. This is where we are in the UK though. I'm able to publish these reviews because I'm actually a customer of the institutions!

If you'd like to show off about just how good your financial services (or other!) Conversational AI installation is, please reach out and give me access to your test accounts so I can do a review.

Do you need some help? Please do send me a note if you'd like to discuss how I might be able to help your Conversational AI or chatbot plans. I can help with all aspects of your programme from research, ideas, PoCs, diagnosis through to Conversational AI Maturity, RFP and deployment phases.

You can get me here or on LinkedIn if that's easier - here's an easy link: