HSBC UK's chatbot walkthrough - screenshots and write-up

Yesterday I published the video walkthrough of my experience of the HSBC UK chatbot. Do watch that here.

Many have already been asking for the text version with the high-resolution images... so here we go.

First, a bit of background. Last year HSBC – the global bank – earned $66 billion in revenue and posted a profit before tax of $30.3 billion. Deeply impressive earnings. In terms of size, HSBC is #7 on the list of the largest banks on the planet according to Wikipedia's 'list of largest banks'. Investopedia reckons they're #6. Whatever list you look at though, you'll find HSBC near the very top.

So, for context, they're big.

In this walkthrough, I'm going to show how their Conversational AI chatbot manages the same question I asked both Lloyds and NatWest's Virtual Assistants. Referring to the HSBC chatbot as a Conversational AI feels a little inaccurate as it looks very much like a series of response-based decision tree prompts.

Here's the question I asked:

How do I get a replacement card?

Let's begin.

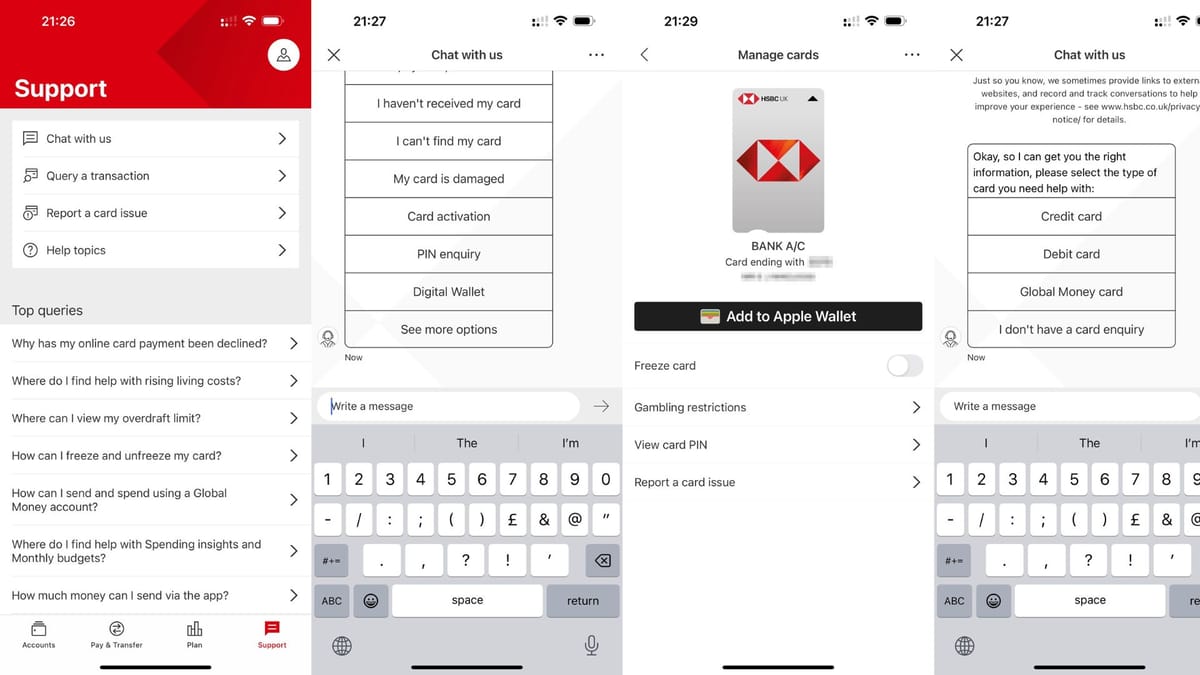

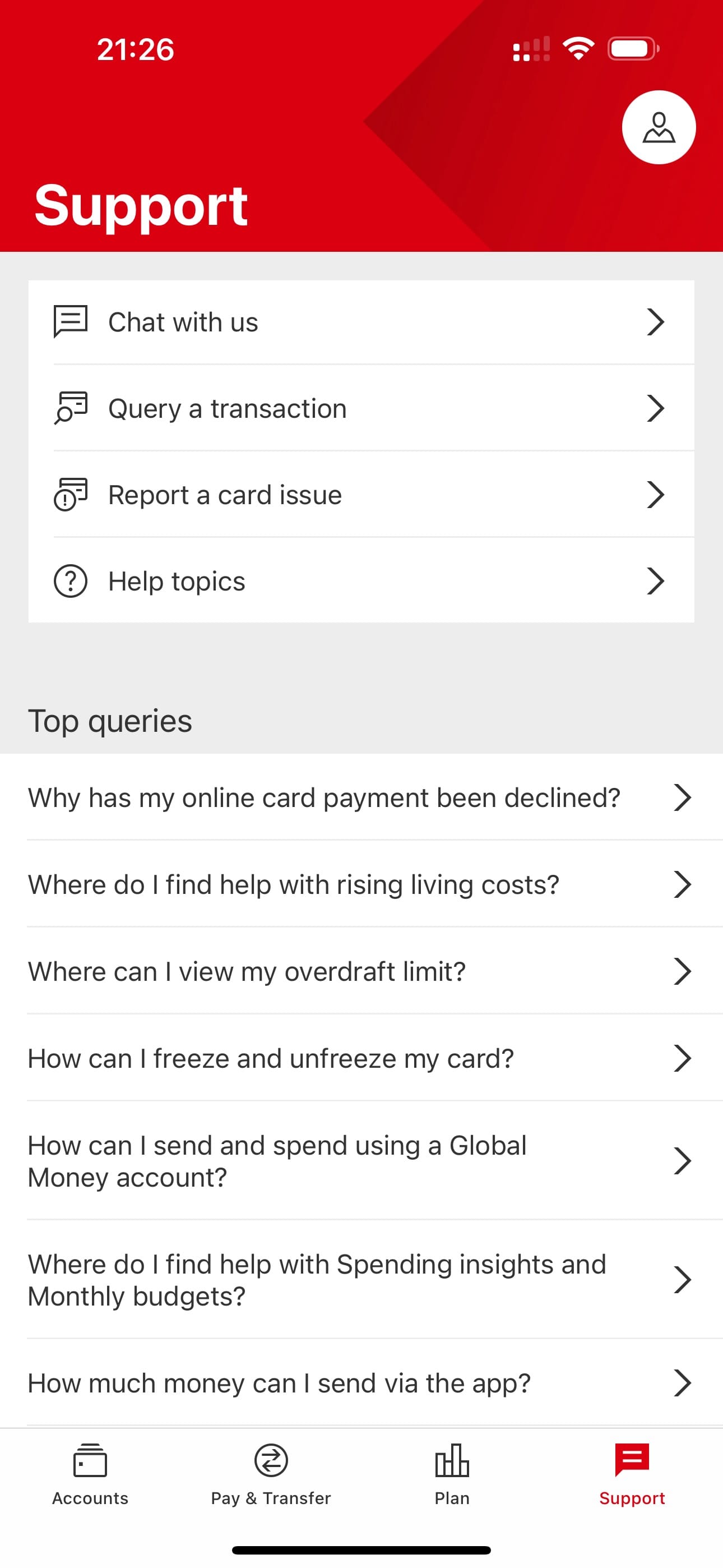

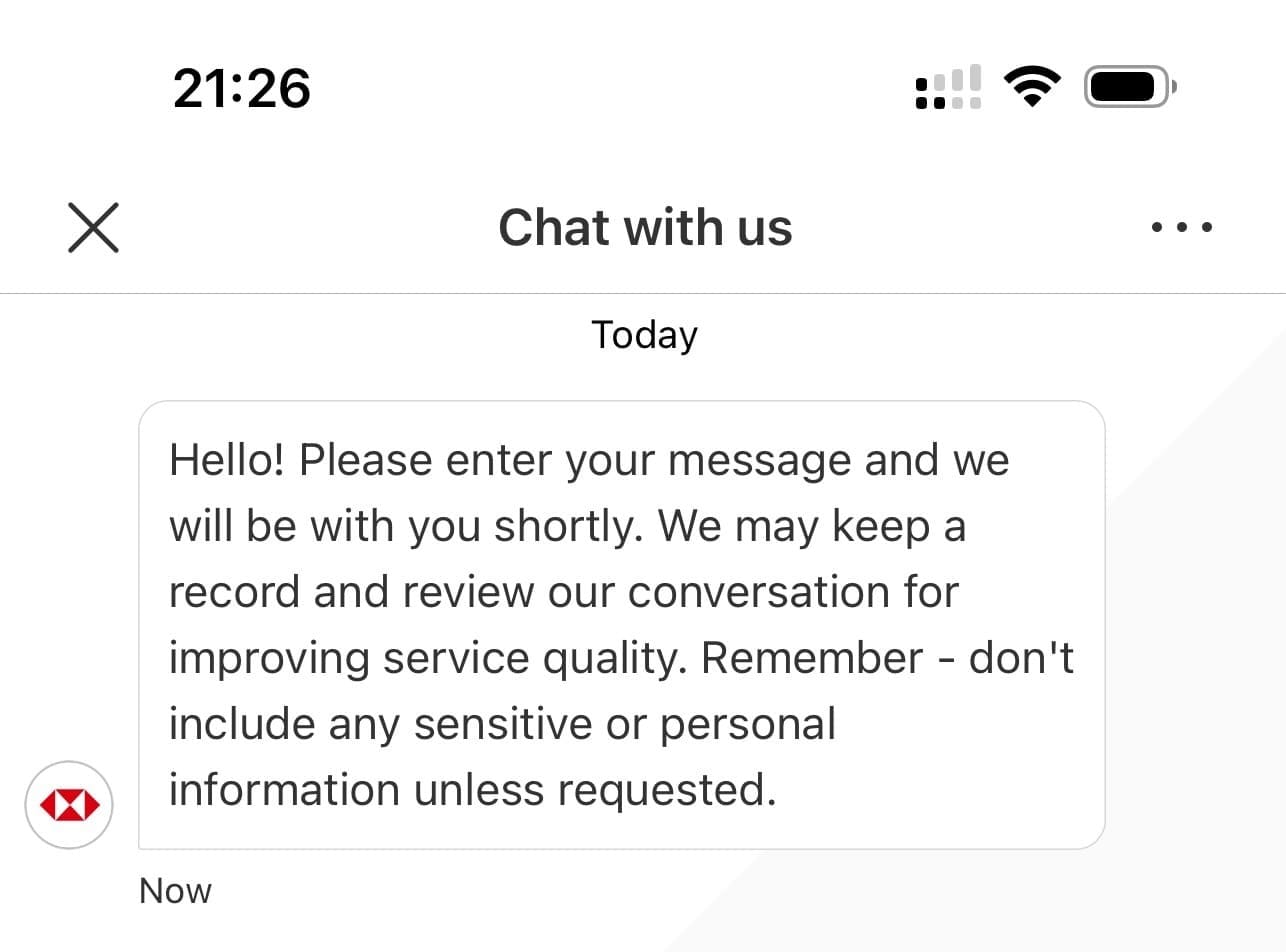

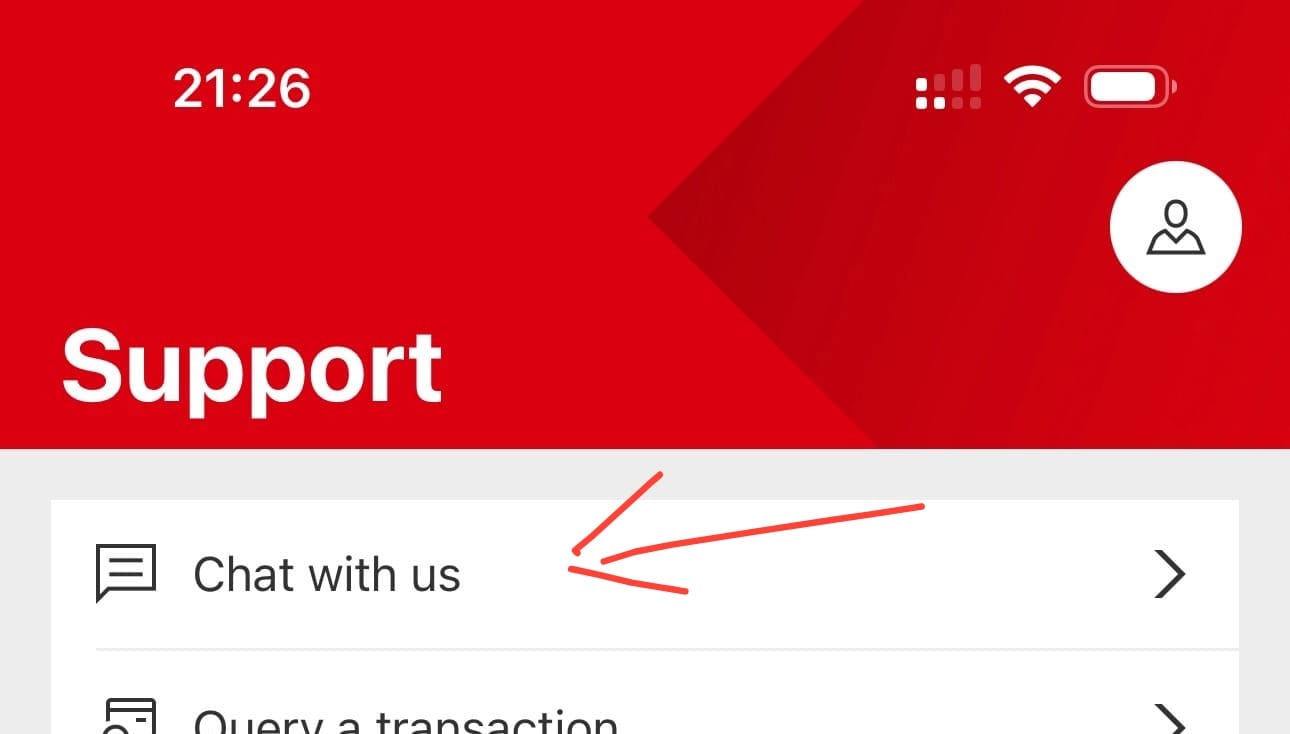

You access the chatbot by clicking on one of the main sections at the bottom of the mobile app - "Support".

The top action is "Chat with us". That takes you straight into the chatbot screen, still inside the app.

The first message from the chatbot is simple and clear. Note that it doesn't bother with a "please keep your answers to less than 15 words" warning like Lloyds insisted upon. Instead, the text encourages users to keep their questions "short". This is a lot more user-friendly.

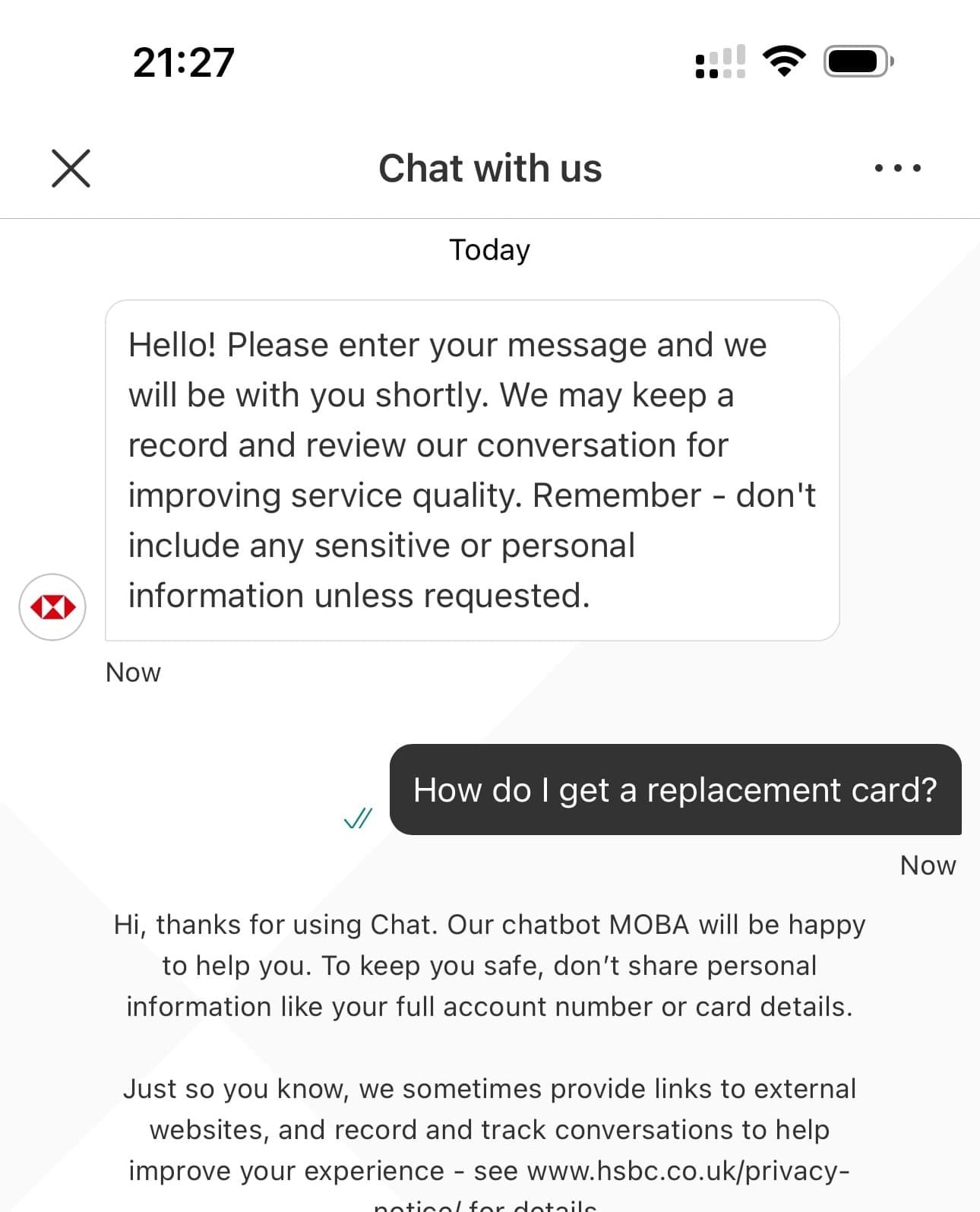

I ask my question.

Interestingly, just like Lloyds, for some crazy reason, the system feels obliged to throw up some additional tiny text. It reads:

Hi, thanks for using Chat. Our chatbot MOBA will be happy to help you. To keep you safe, don't share personal information like your full account number or card details...

I find the placement of the text feels rather odd.

What's even stranger is the first-ever mention of the chatbot's name, MOBA.

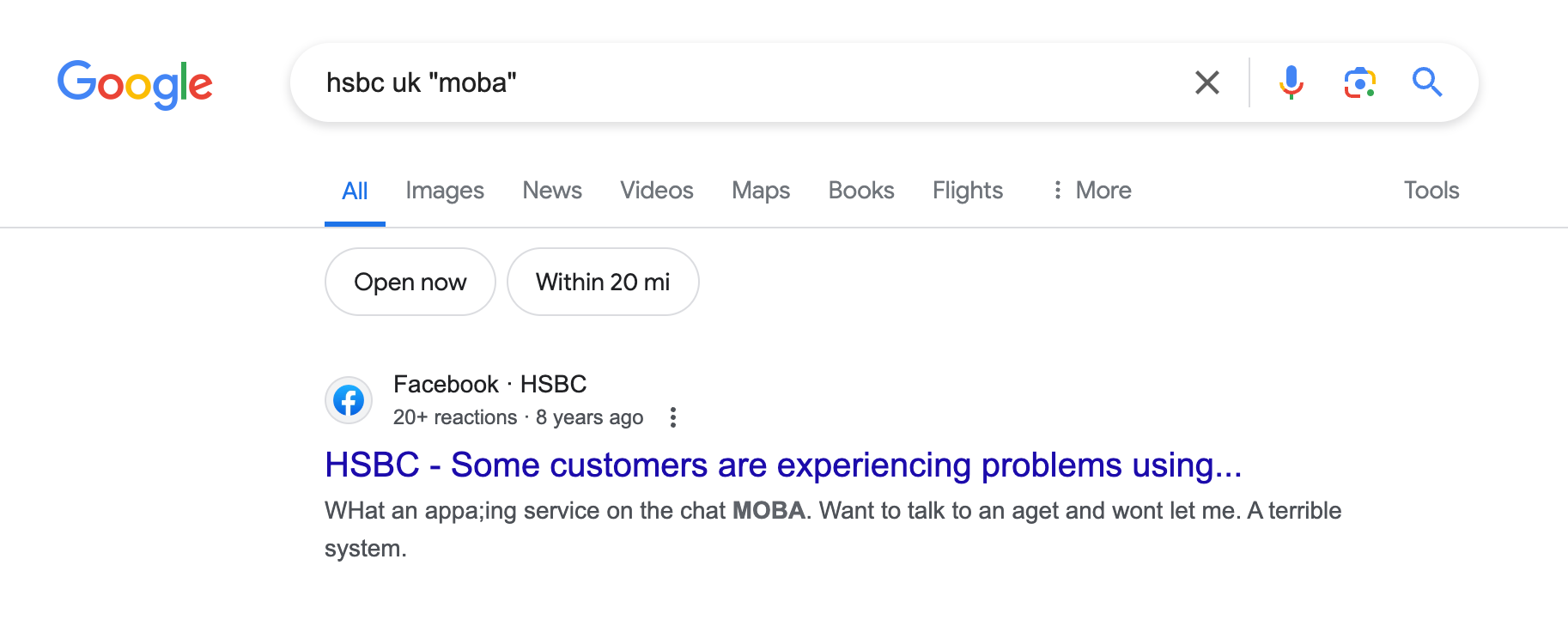

I hunted around on the internet to find any reference to HSBC and MOBA. I wondered if this was a brand name they were using on the support pages and that perhaps I'd missed it. No. I couldn't find anything.

I did find this reference:

It's a Facebook message from 8 years ago referencing MOBA.

That's the only reference I could find.

For a bank with the reputation and technical capability of HSBC, I'm surprised that their brand team authorised this kind of approach.

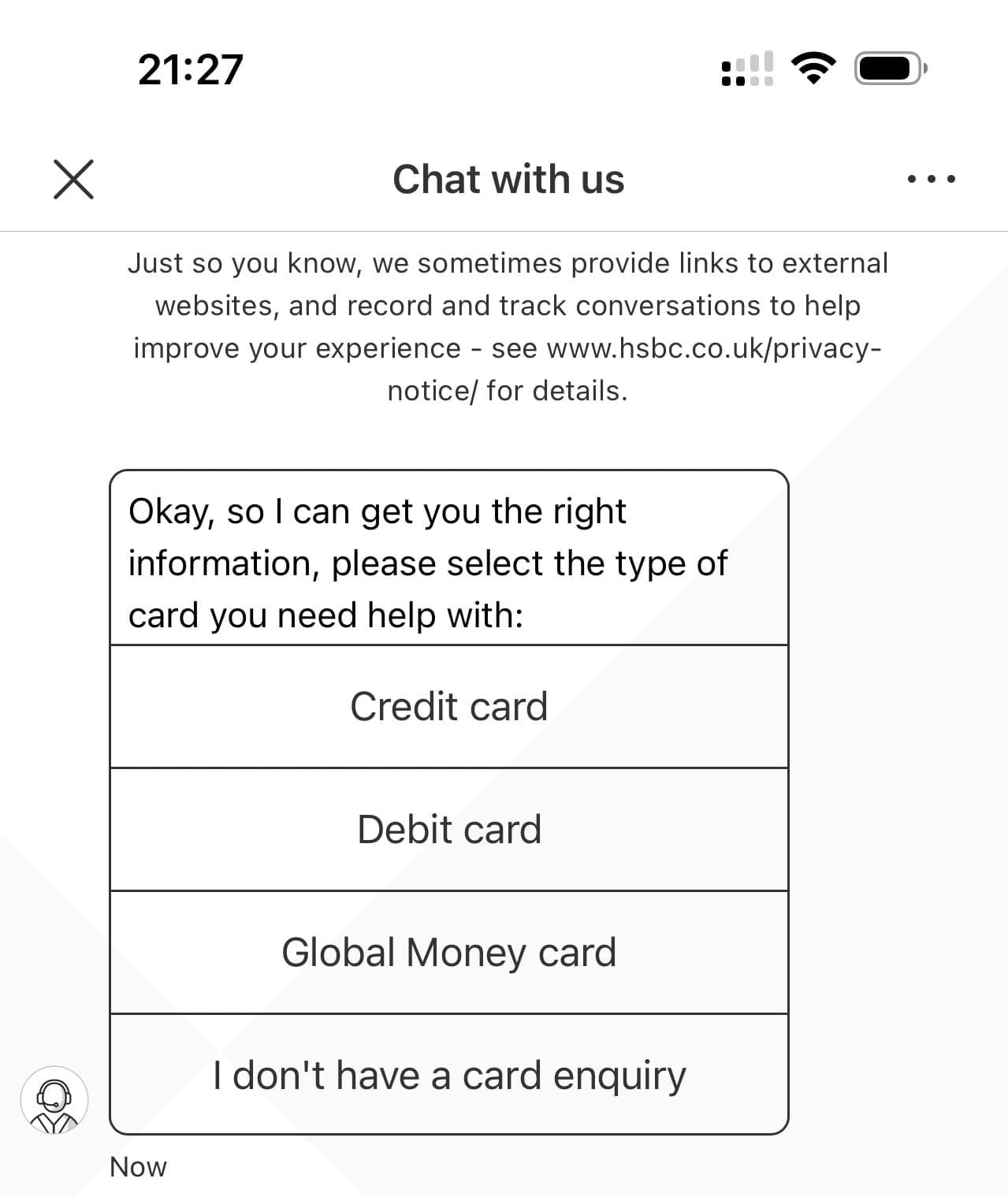

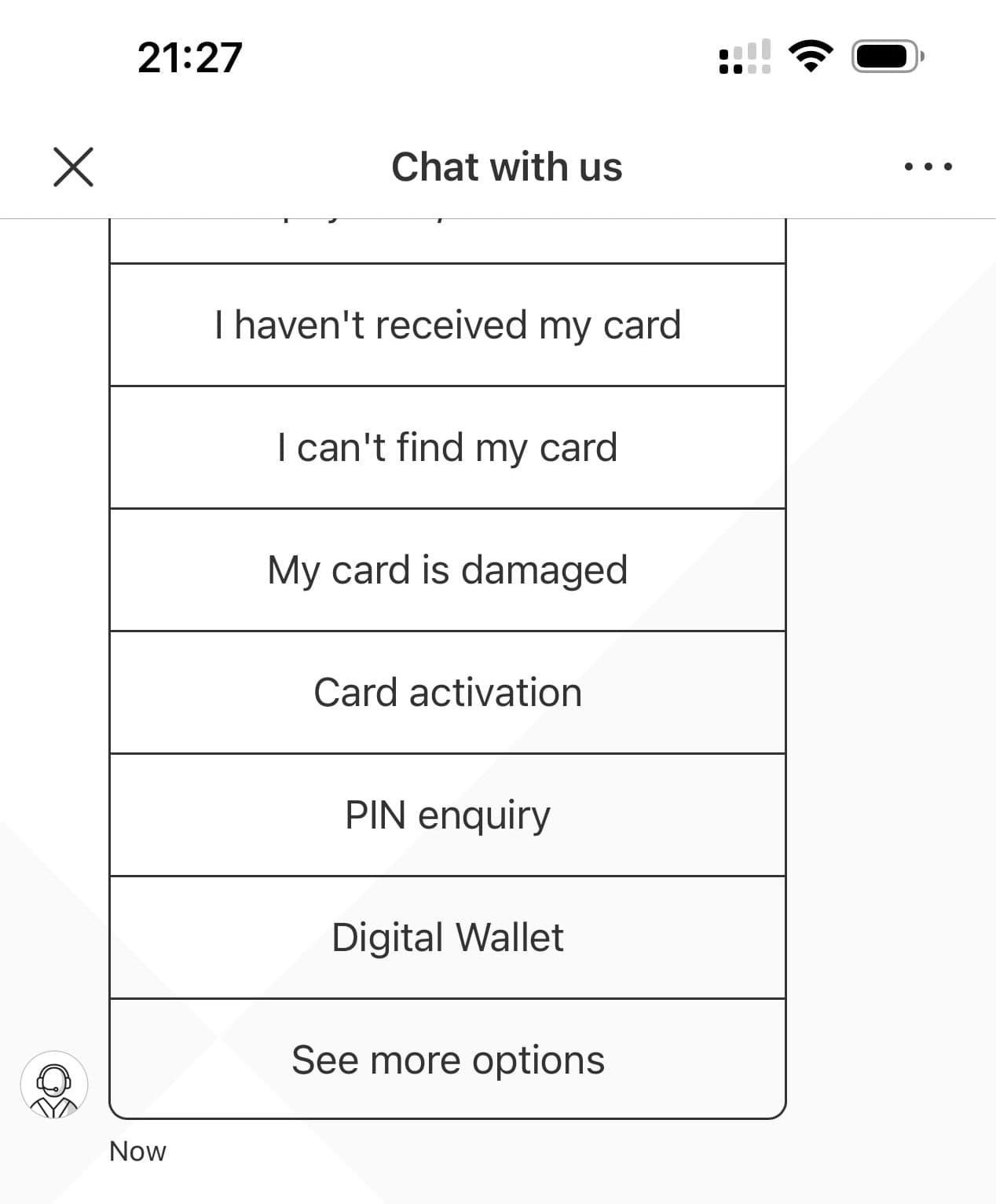

After reading the tiny message, MOBA (I shall refer to it by name from now on!) prompted me with this question and answer choice.

This is good. It's understood the underlying intent of my request.

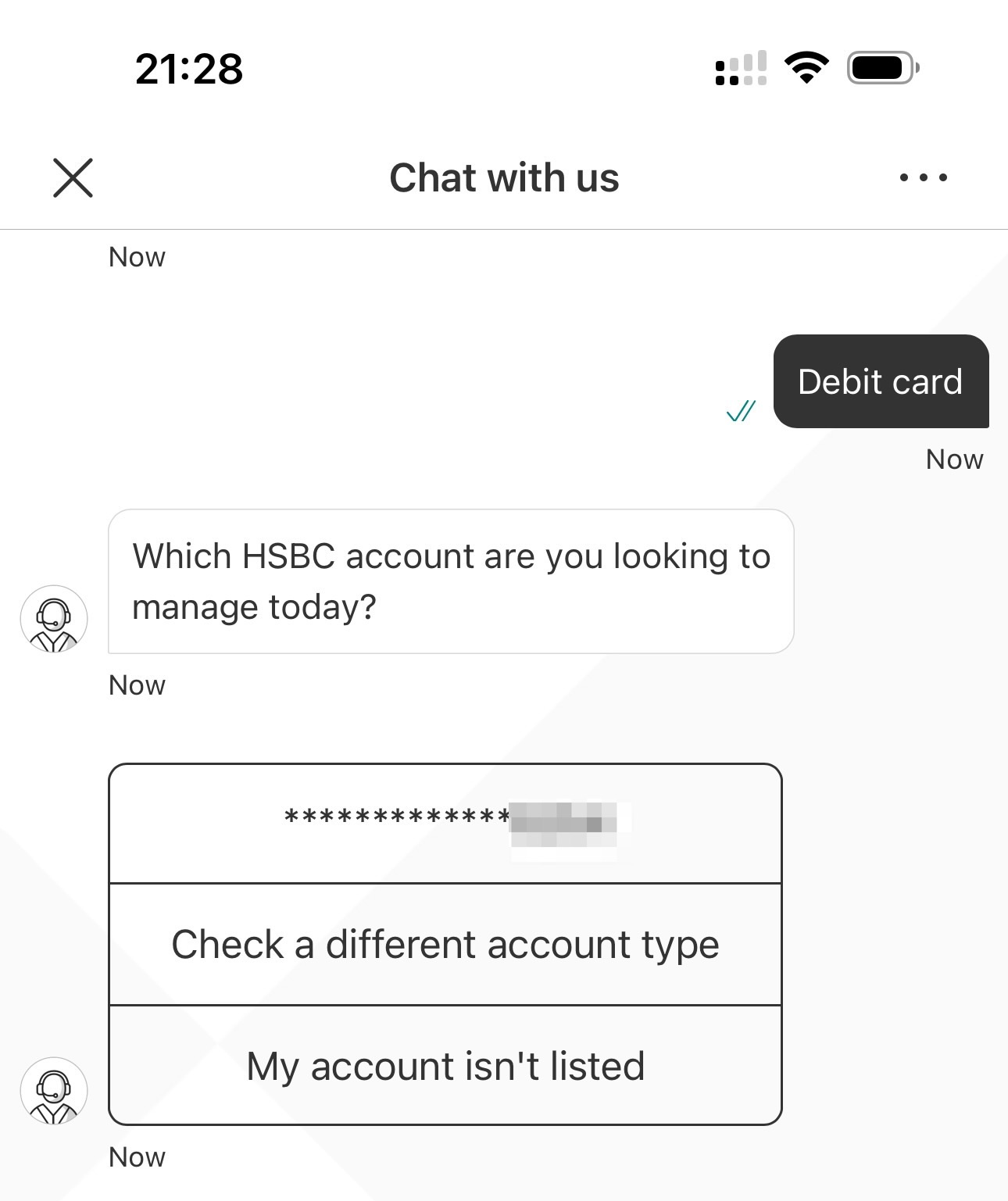

I selected Debit card.

Then I'm very quickly presented with the above options related to card replacement.

I selected My card is damaged in keeping with the same approach I used with Lloyds and NatWest.

So far, so good.

MOBA has understood my issue and is prompting me in a manner that feels sensible and relevant.

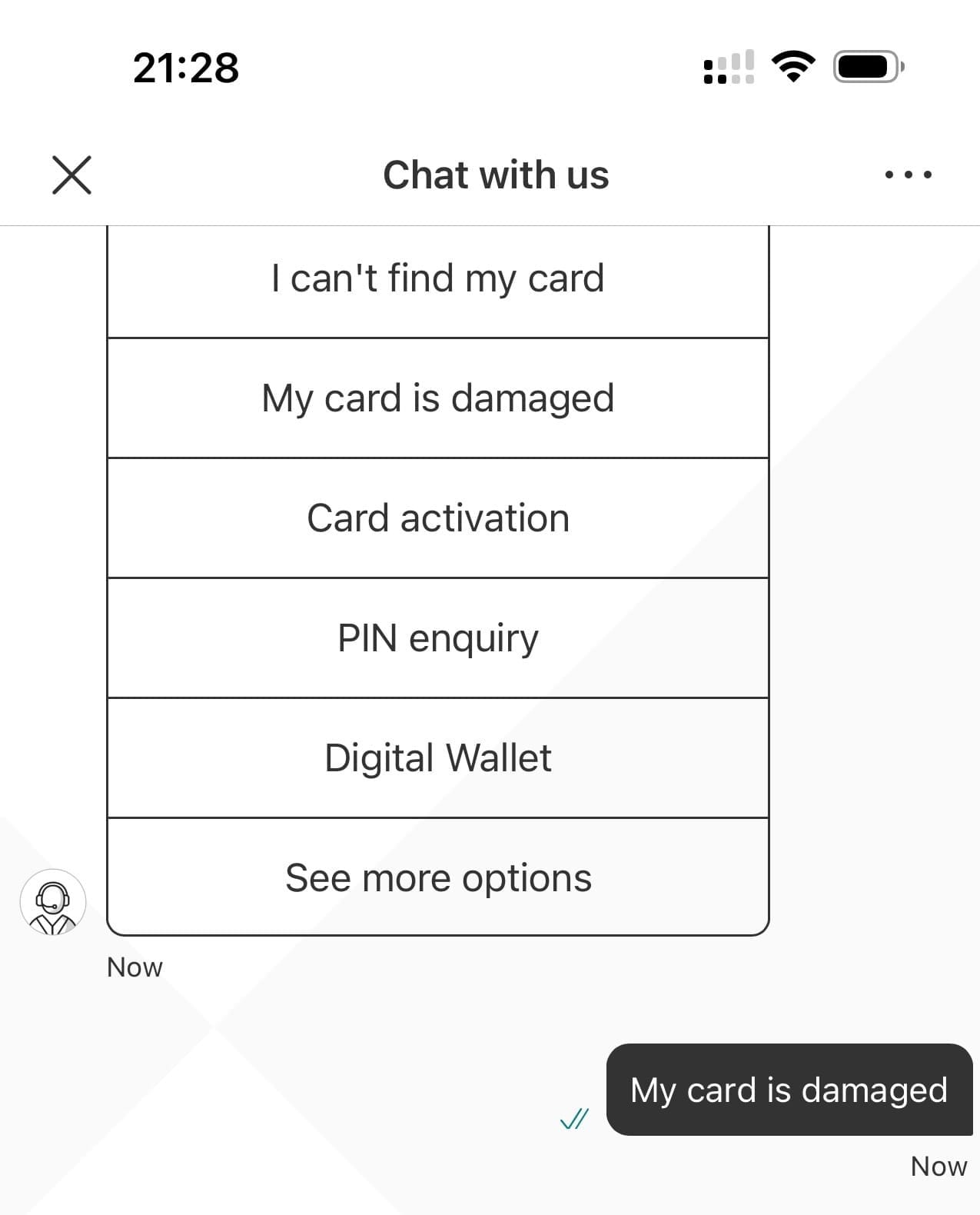

I tap on the My card is damaged option....

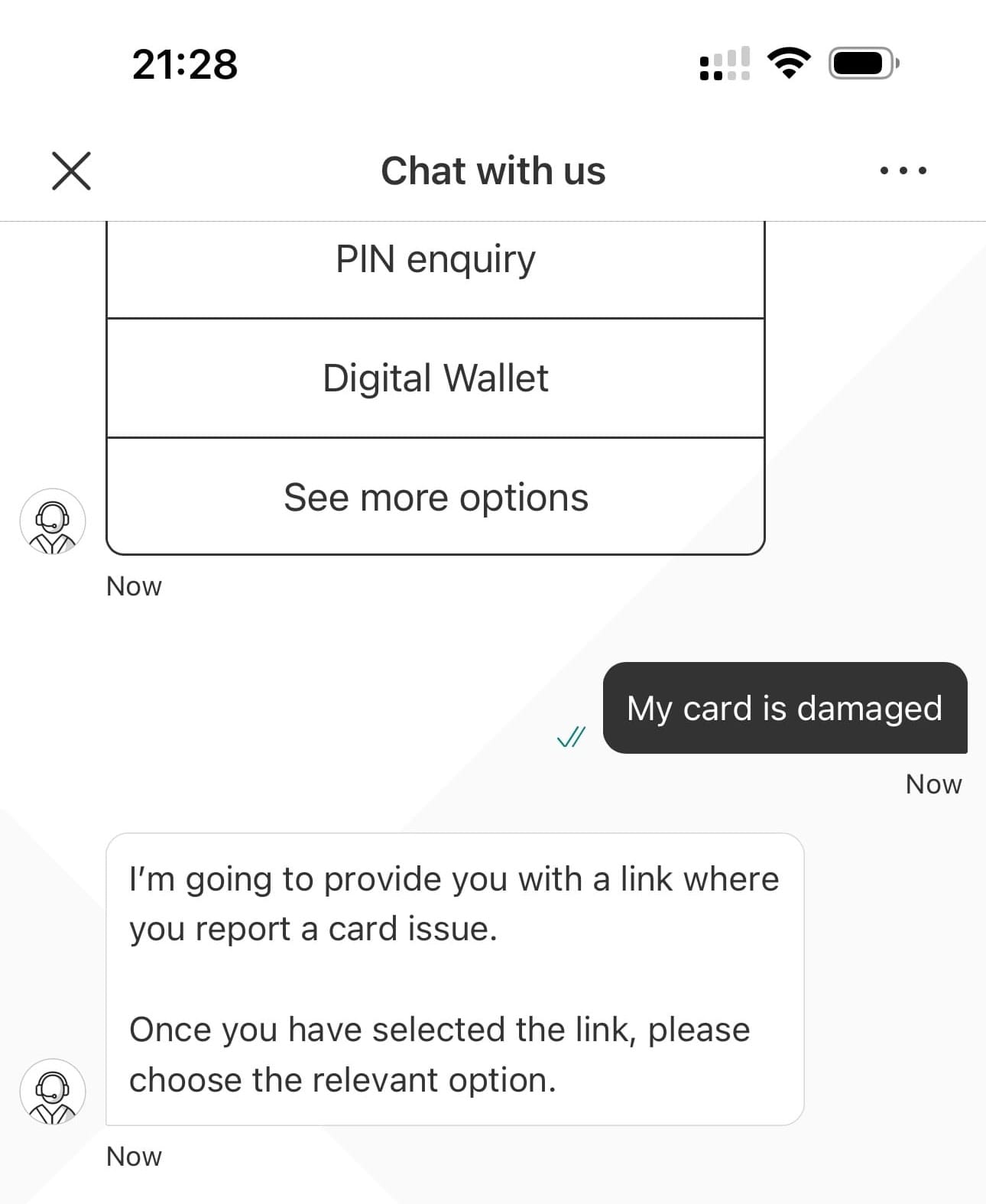

MOBA responds with a link for me.

This is the first disappointment. It's ok. The process is working. But I don't want a link to report my card 'issue', I want it resolved.

Let us continue.

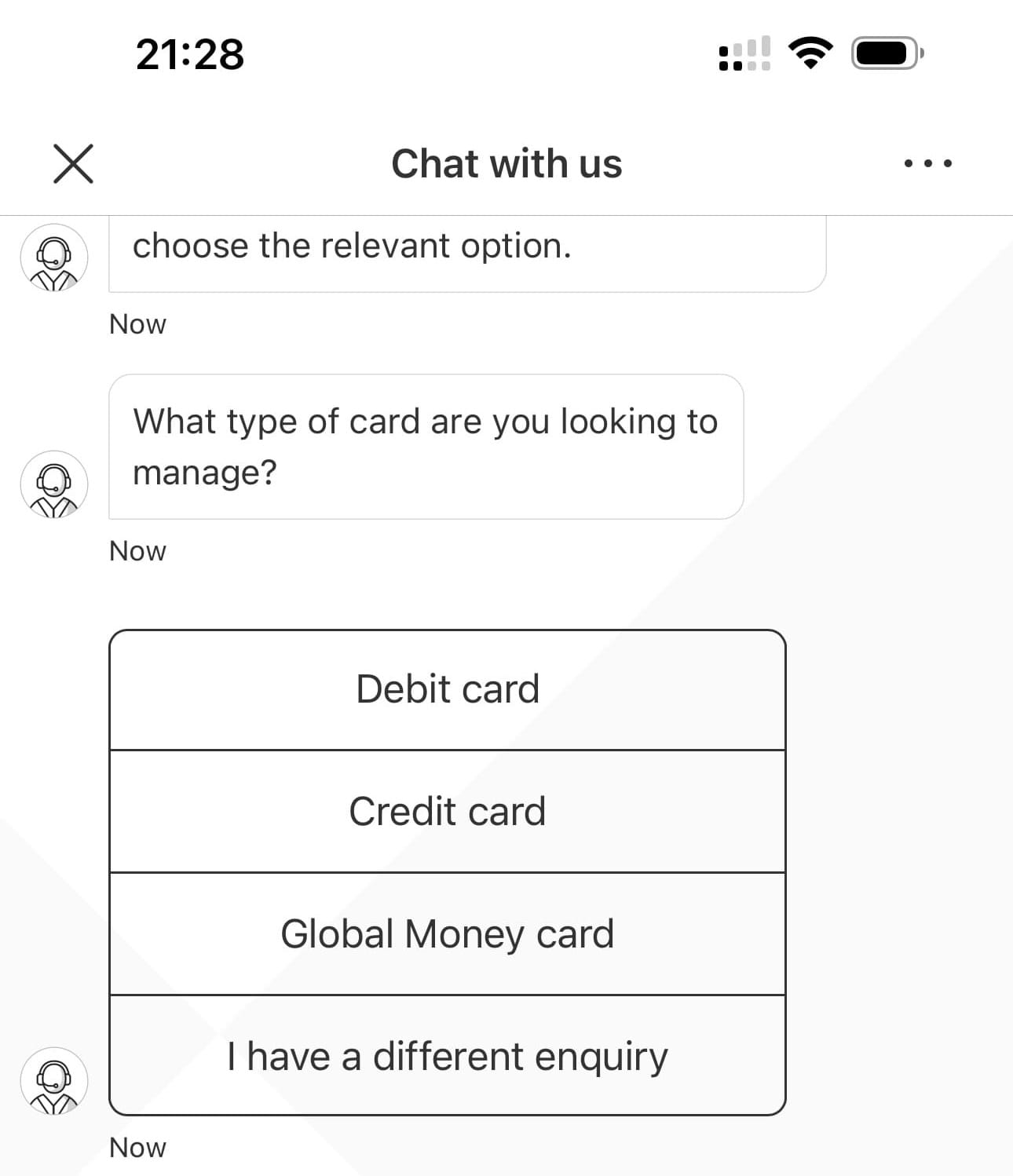

The above screen popped up again.

It seems MOBA isn't as together as I thought. It's asking me again to define what type of card...

Once more, I tap Debit card.

MOBA then prompts me to identify the related bank account. This is good. It's reached into the HSBC core and found my bank details. I recognise the account number.

I tap on that.

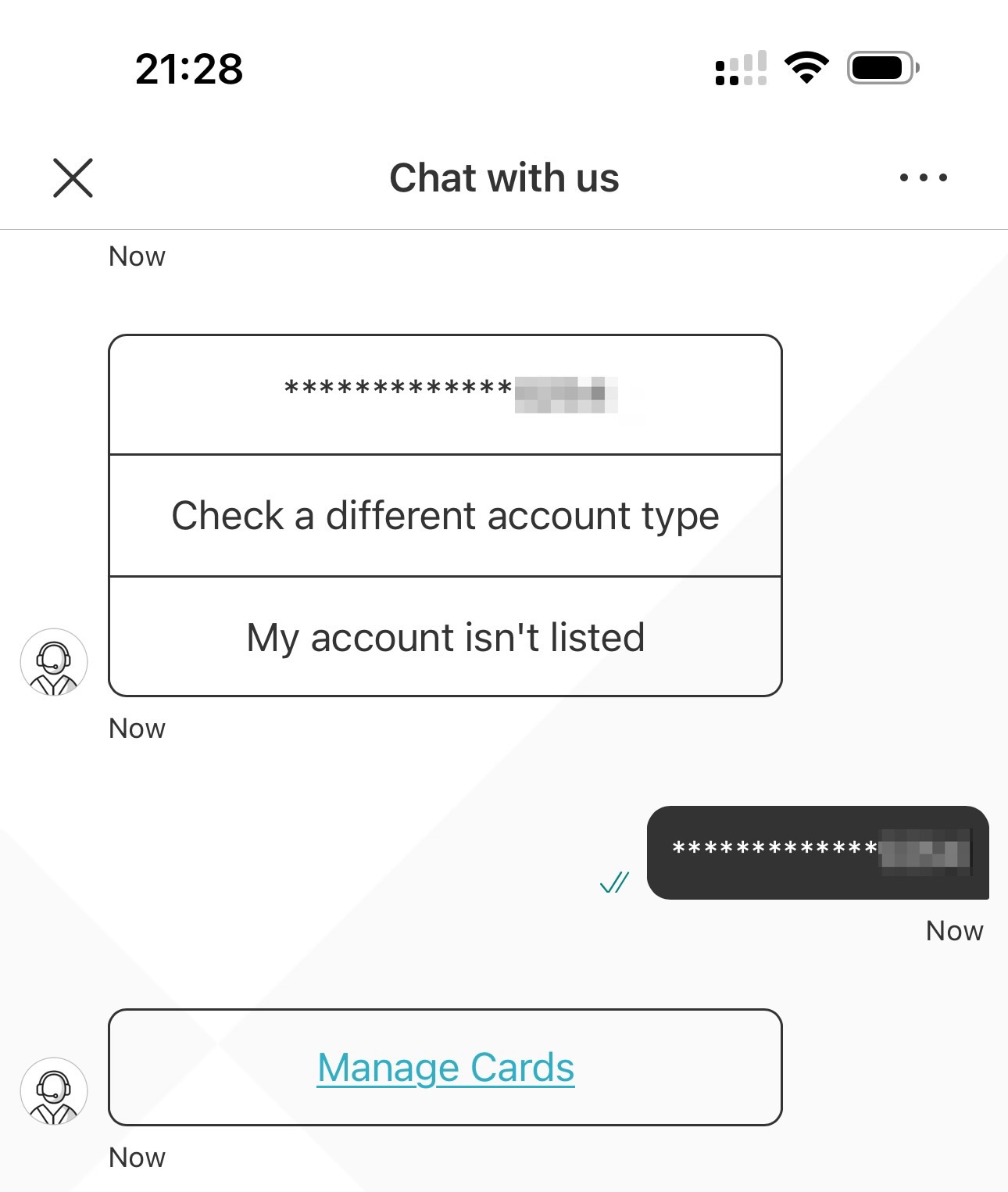

And there we go. It's now prompted me with a Manage Cards link.

This is almost identical to the Lloyds system. They must be using the same vendor.

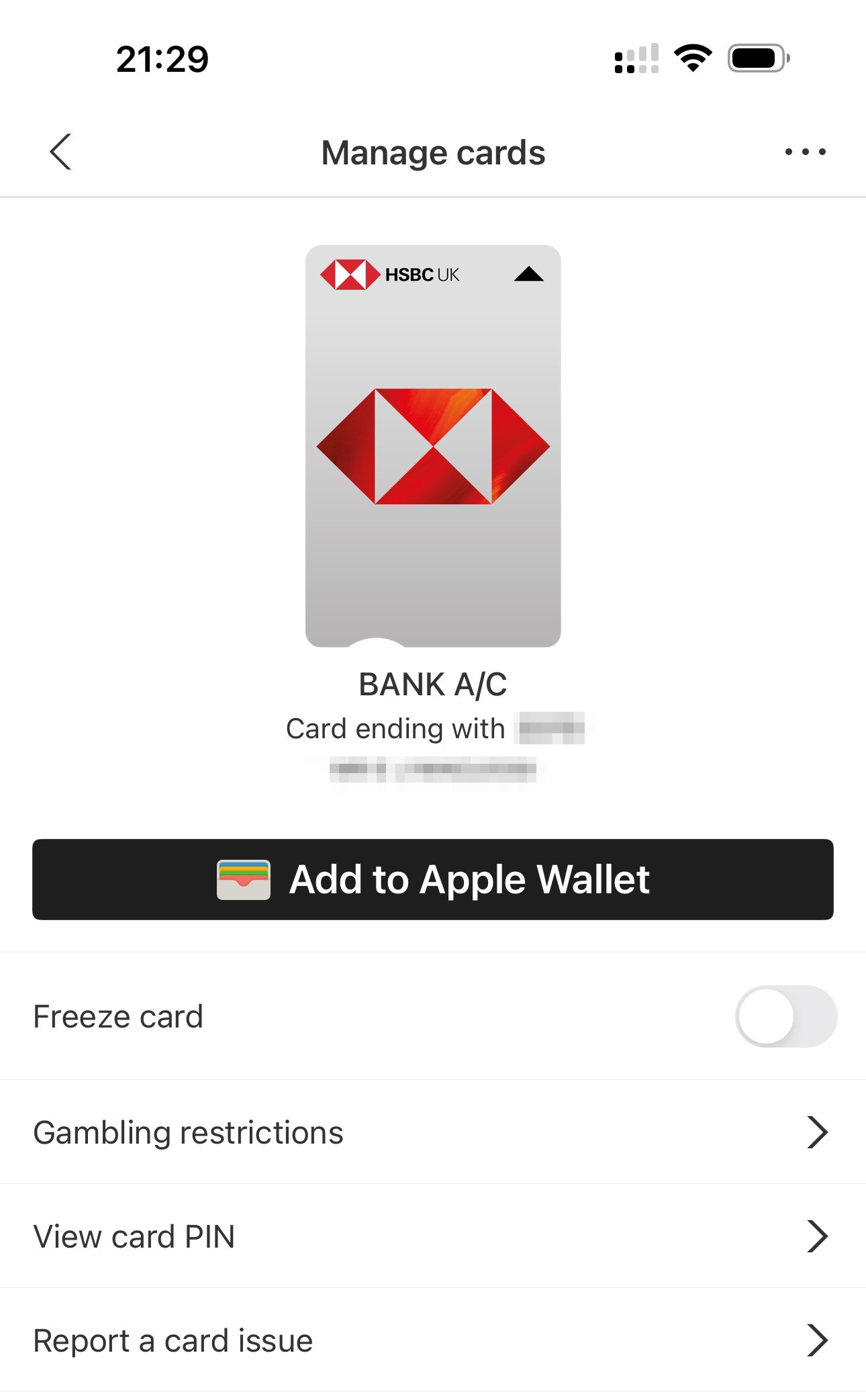

I tap on Manage Cards... this opens a 'deep link' within the mobile app that takes me to a card management page:

I tap "Report a card issue" and go through the same 'is it damaged' etc. process.

This is a bit annoying.

It works. Sort of. It still requires me to tap Report a card issue. It didn't take me straight there.

So this is a little annoying too.

As an expert user, I'm frustrated that MOBA is essentially a somewhat convoluted text-based search feature for the mobile app.

I won't bother showing you the various mobile app screens – essentially it appears you can complete the process in about 4 more steps. I'd suggest this is 4 more steps than is necessary, but again, at least it works. I haven't had to phone the call centre.

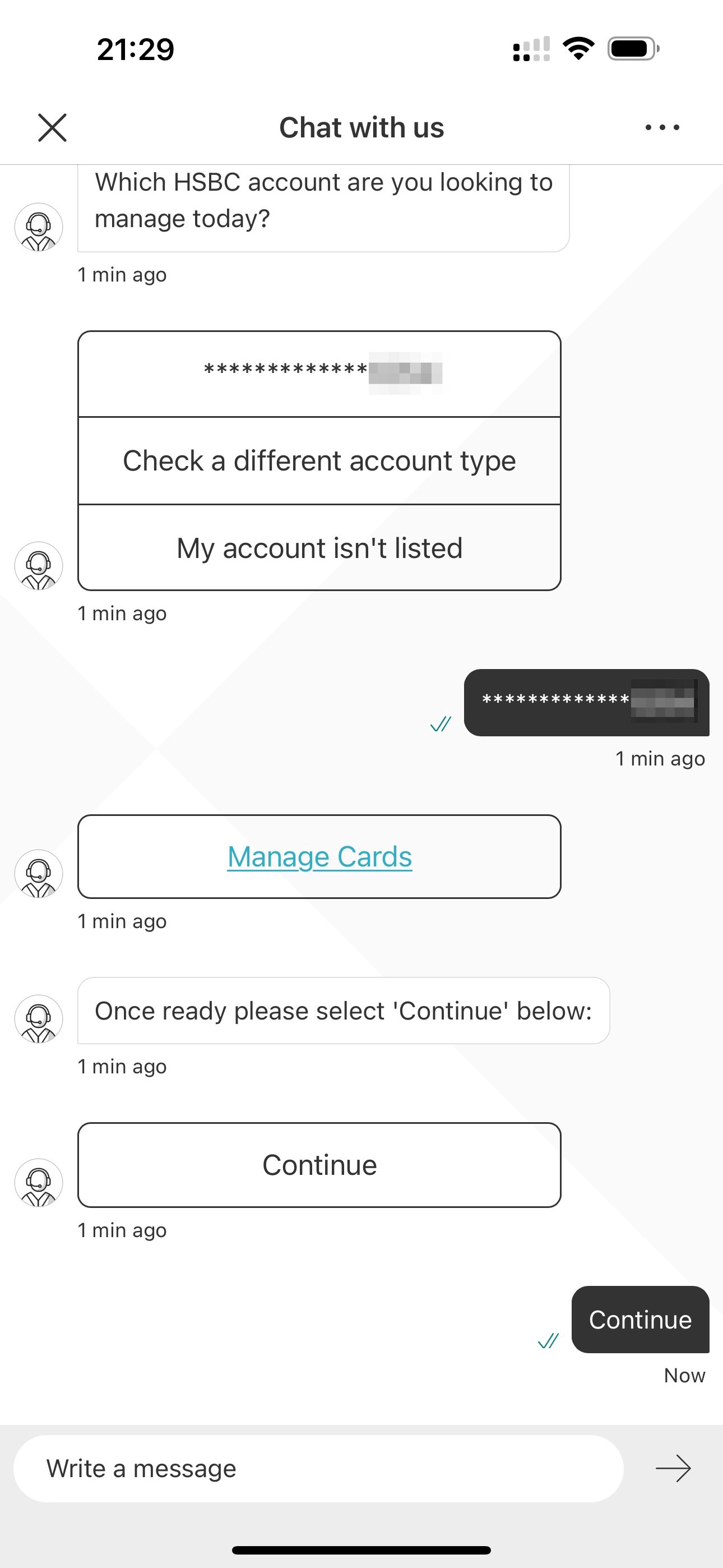

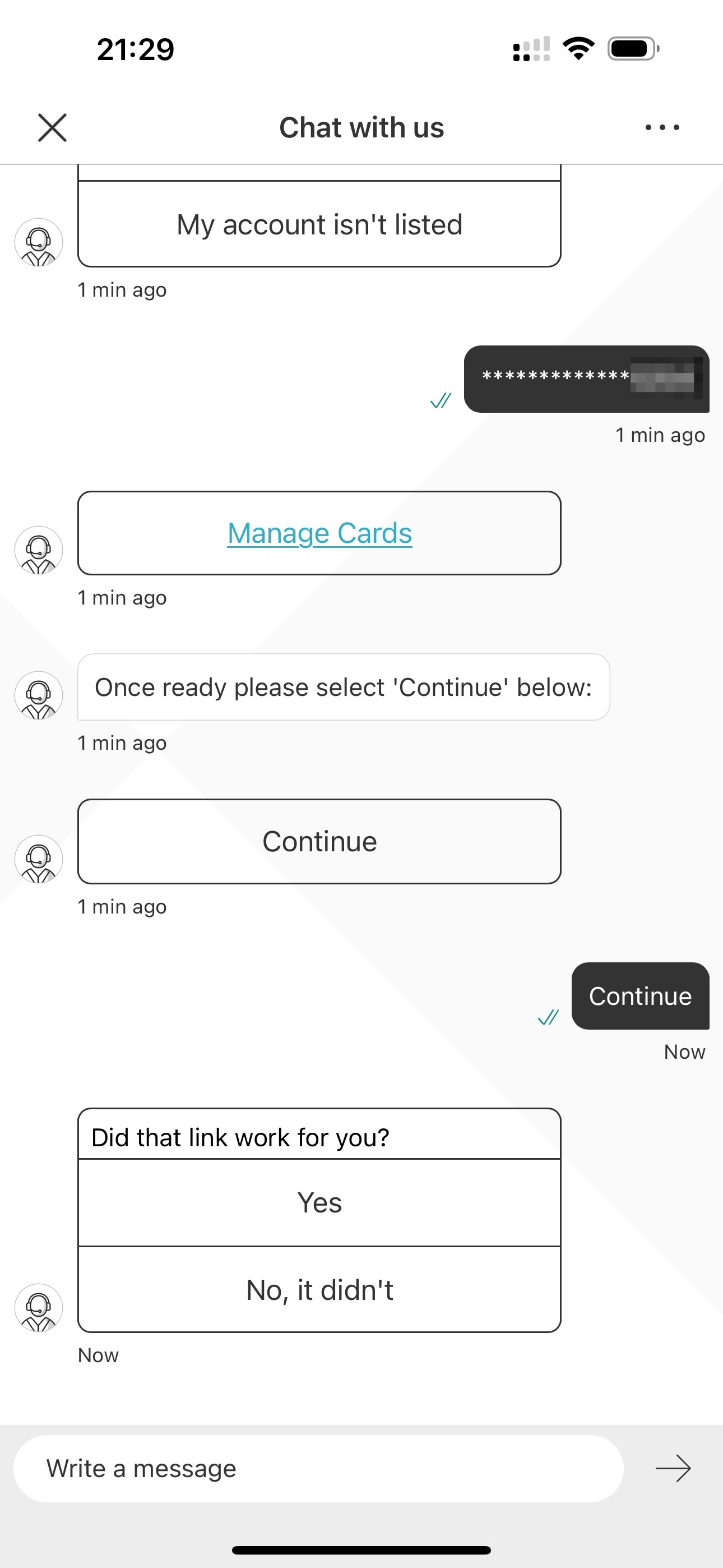

I come out of the cards section, back to MOBA:

I was quite surprised by the "Once ready please select 'Continue' below:' prompt.

I duly did so to see what happened:

And here we go again. Just like Lloyds.

MOBA asks me if the link worked for me.

I find this incredibly frustrating. I'm sure it sounded like a good idea when the process / intent was being programmed, but it's rather ridiculous to be asking me if it worked. I am expecting you to know, HSBC.

I'm not expecting the technology to be so flimsy, or so held-together-with-sticky-tape that you need to check if it worked.

I played the game and selected yes. It did actually work, even if it was frustrating.

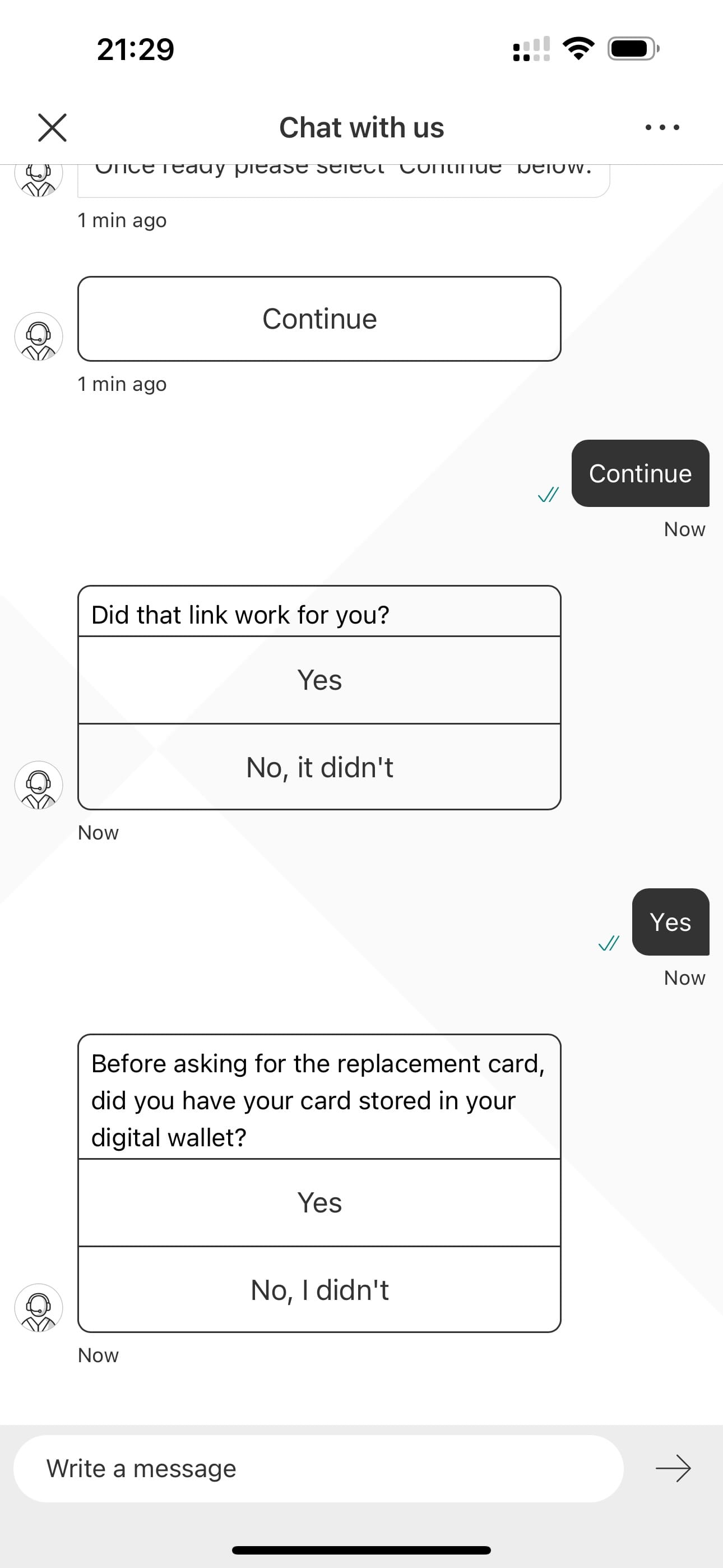

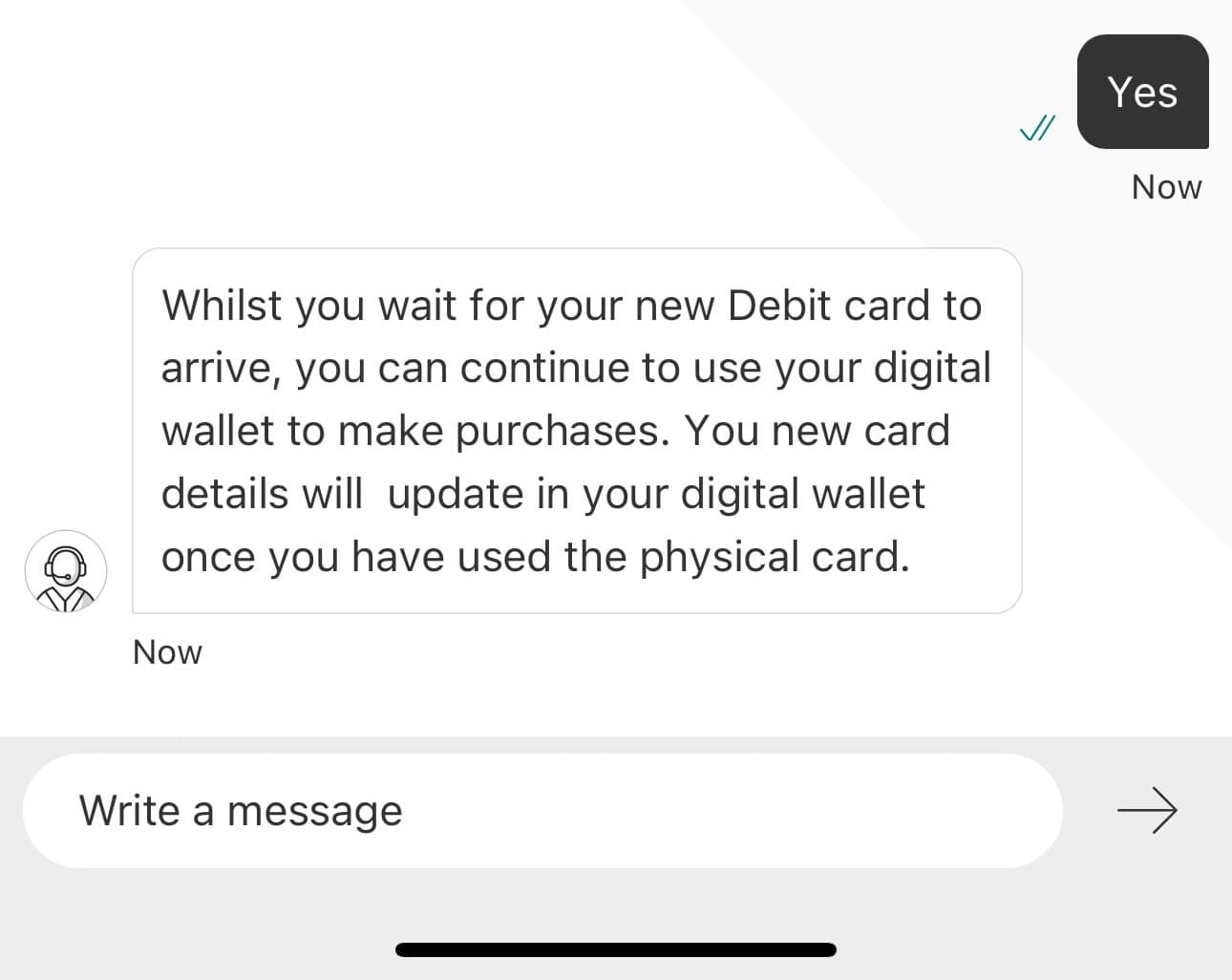

The next step is for MOBA to check if I've got a card stored in a digital wallet (e.g. Apple Pay).

I do. So I selected yes.

That's a helpful and informative comment. It's useful to know that my digital card will still continue to work.

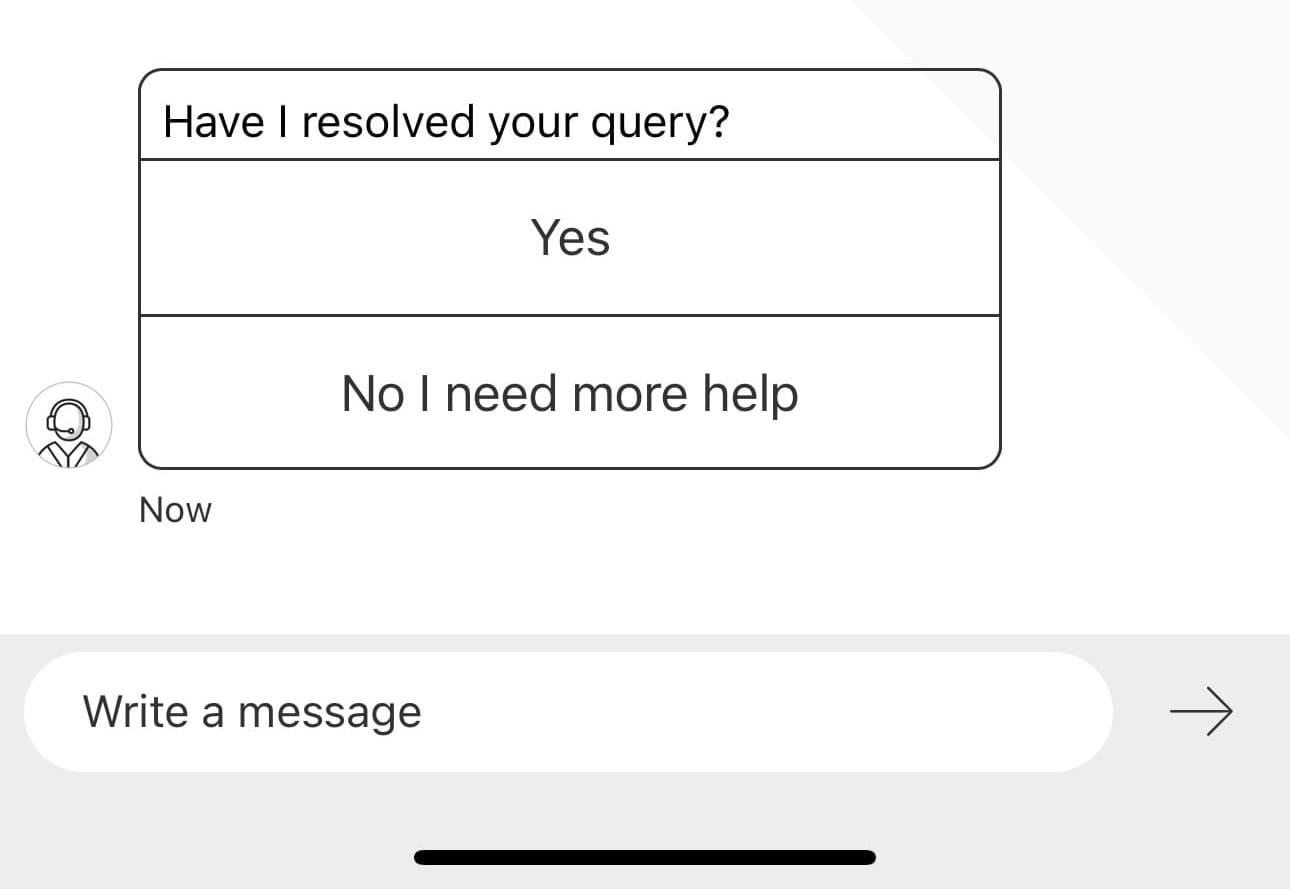

And then, MOBA asks if it has resolved my query.

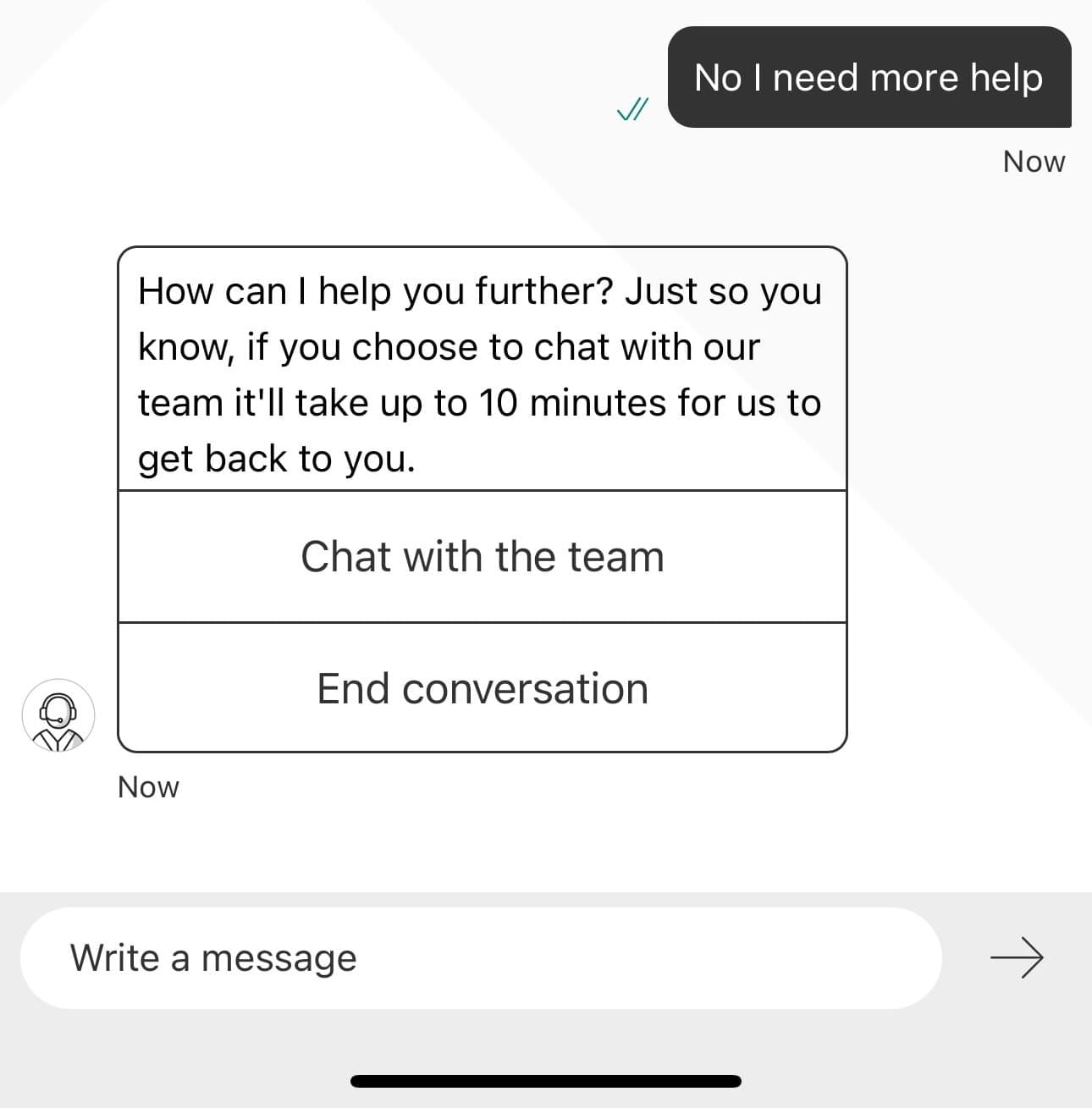

I said No - I wanted to see what would happen:

I wondered if MOBA would try and fix things, perhaps by going through the process again, or attacking the challenge differently. Instead, it has defaulted to escalate to a human.

I think it's useful that it sets expectations by saying 'up to 10 minutes' - I get the feeling that this is hardcoded rather than a live estimate though.

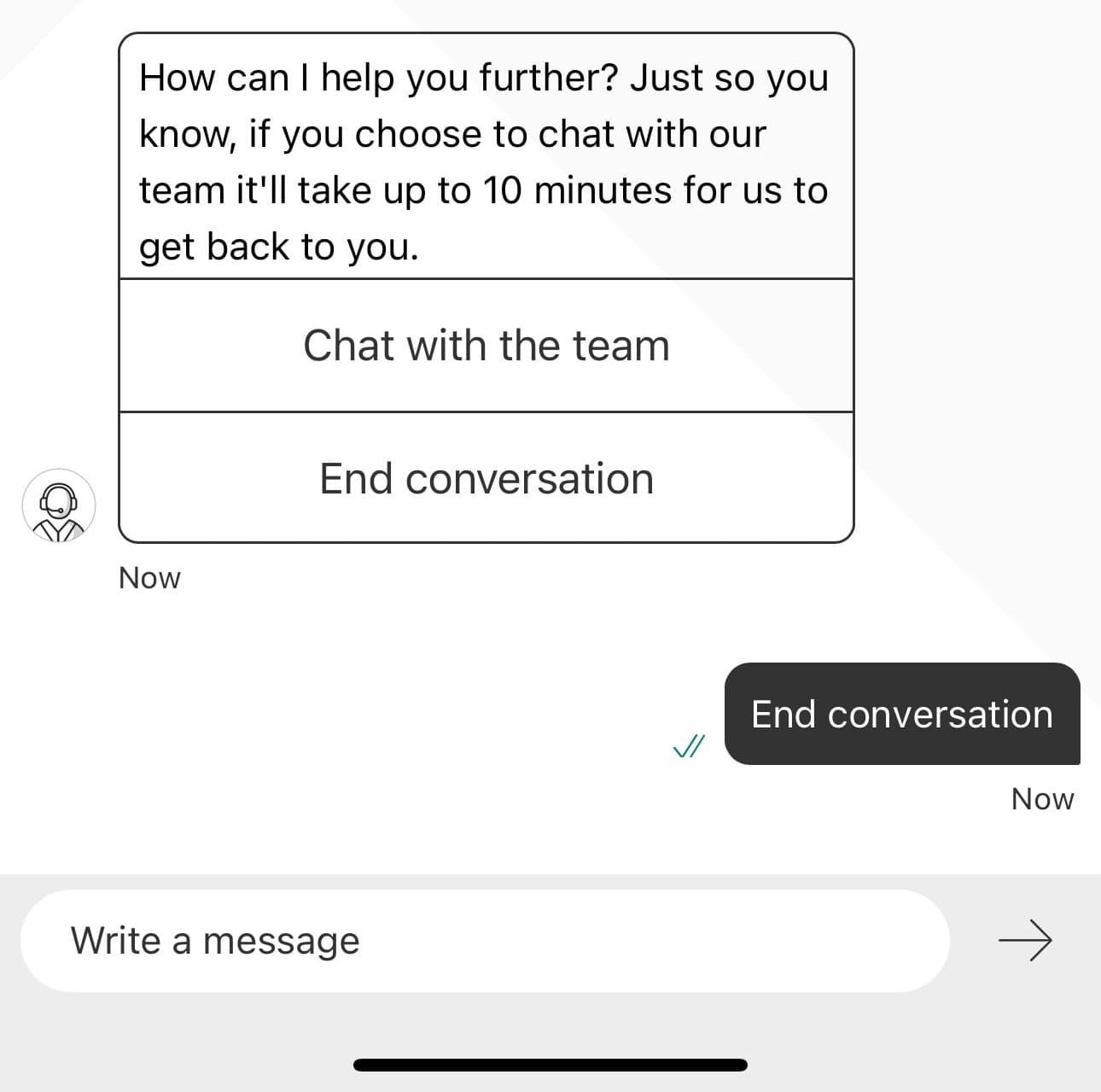

I decided to End conversation.

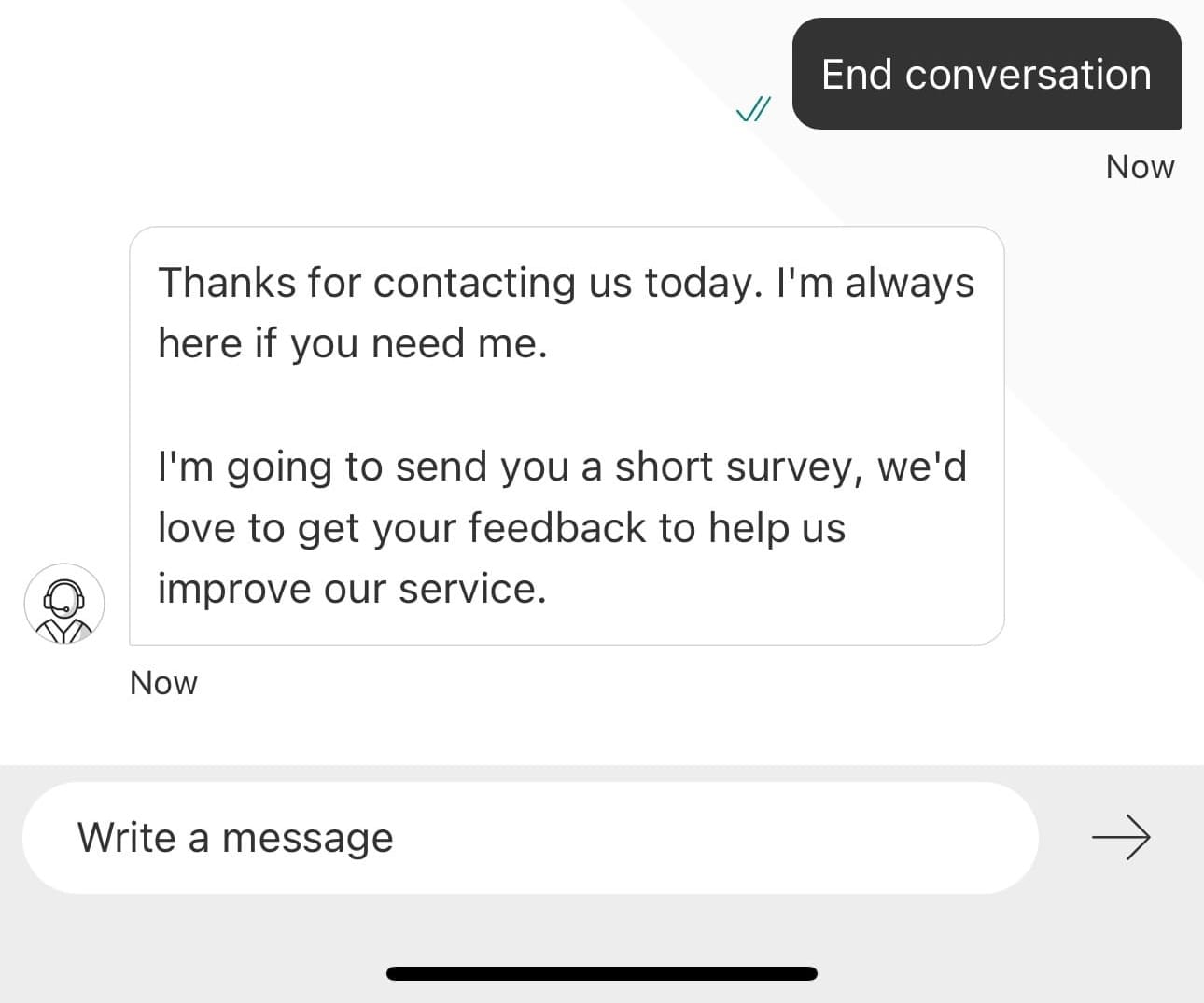

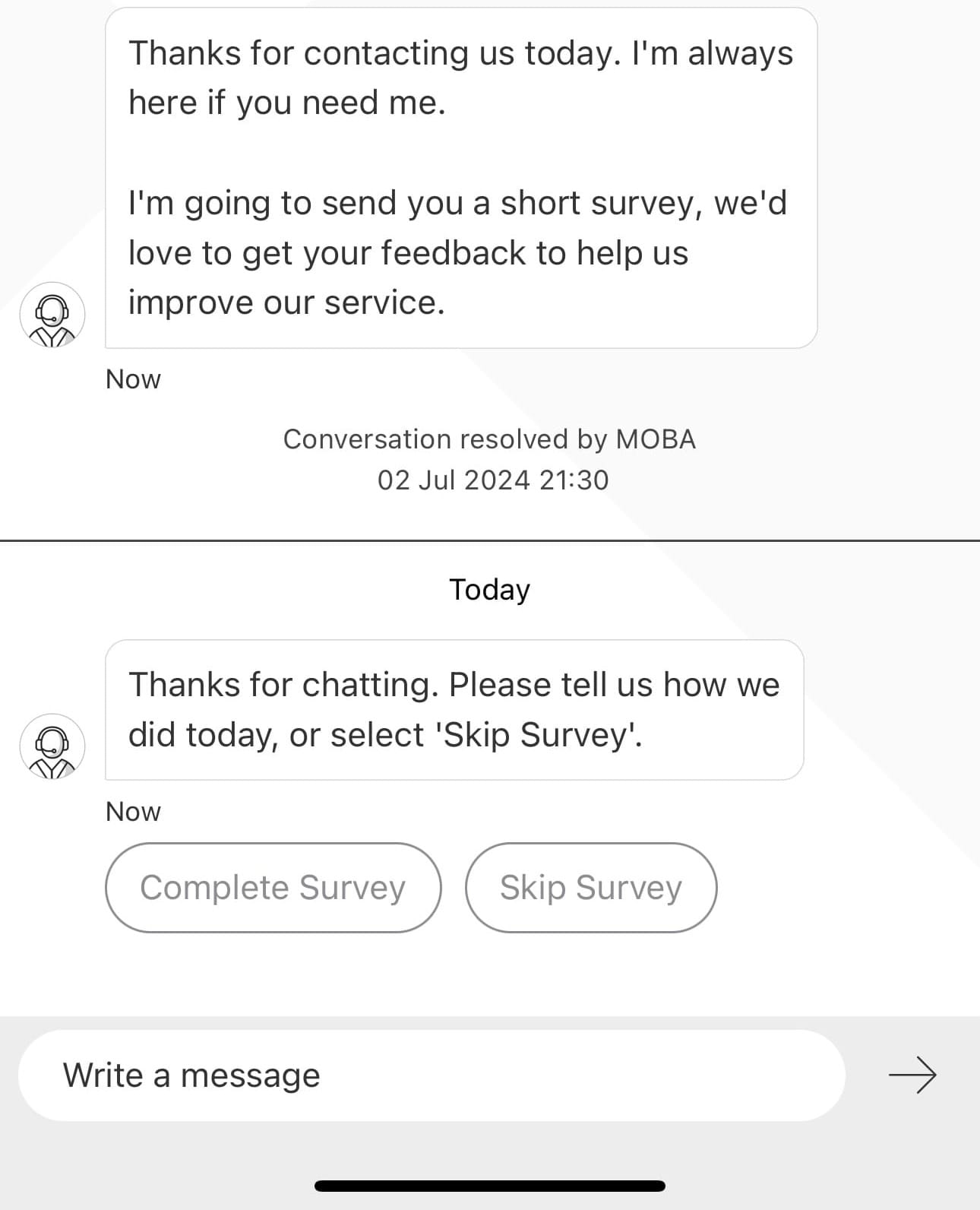

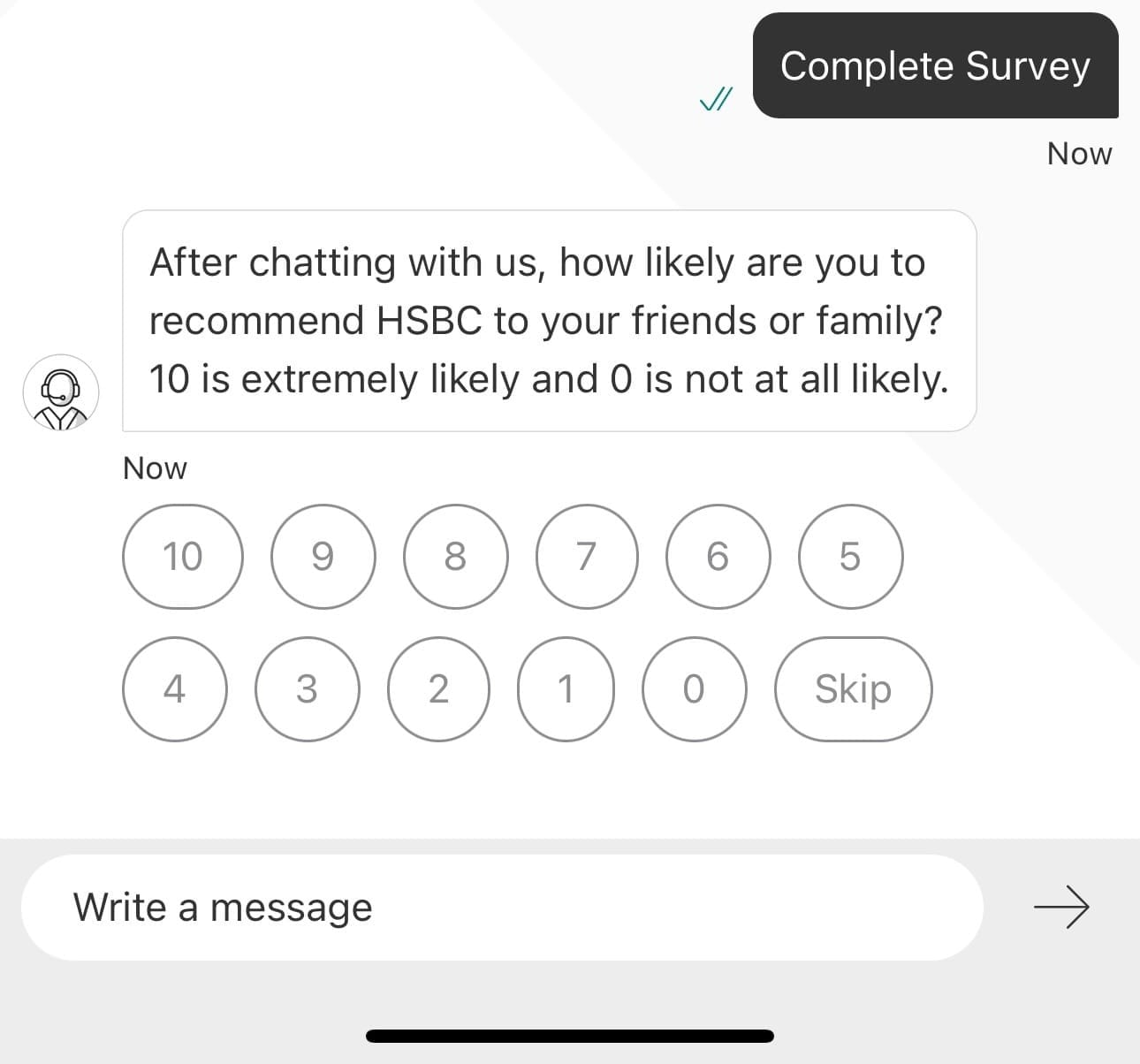

Now it's time for the almost universally obligatory NPS score check.

Note the "Liveperson" style 'Conversation resolved by MOBA' message along with the timestamp. I don't know if this is Liveperson on the back end but it certainly reminds me of similar installations.

I do have the option to Skip but let's see how it handles the survey...

I tapped 10. It asked me why I selected that score. I chose to Skip.

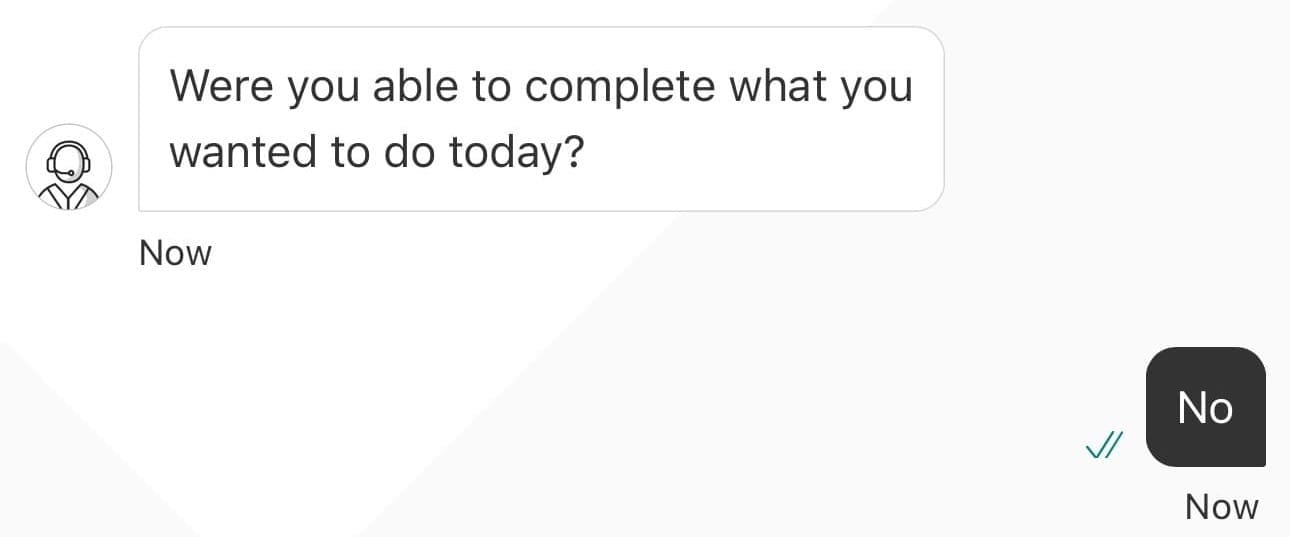

Then MOBA asked if I was able to complete my task.

As a test, I selected No.

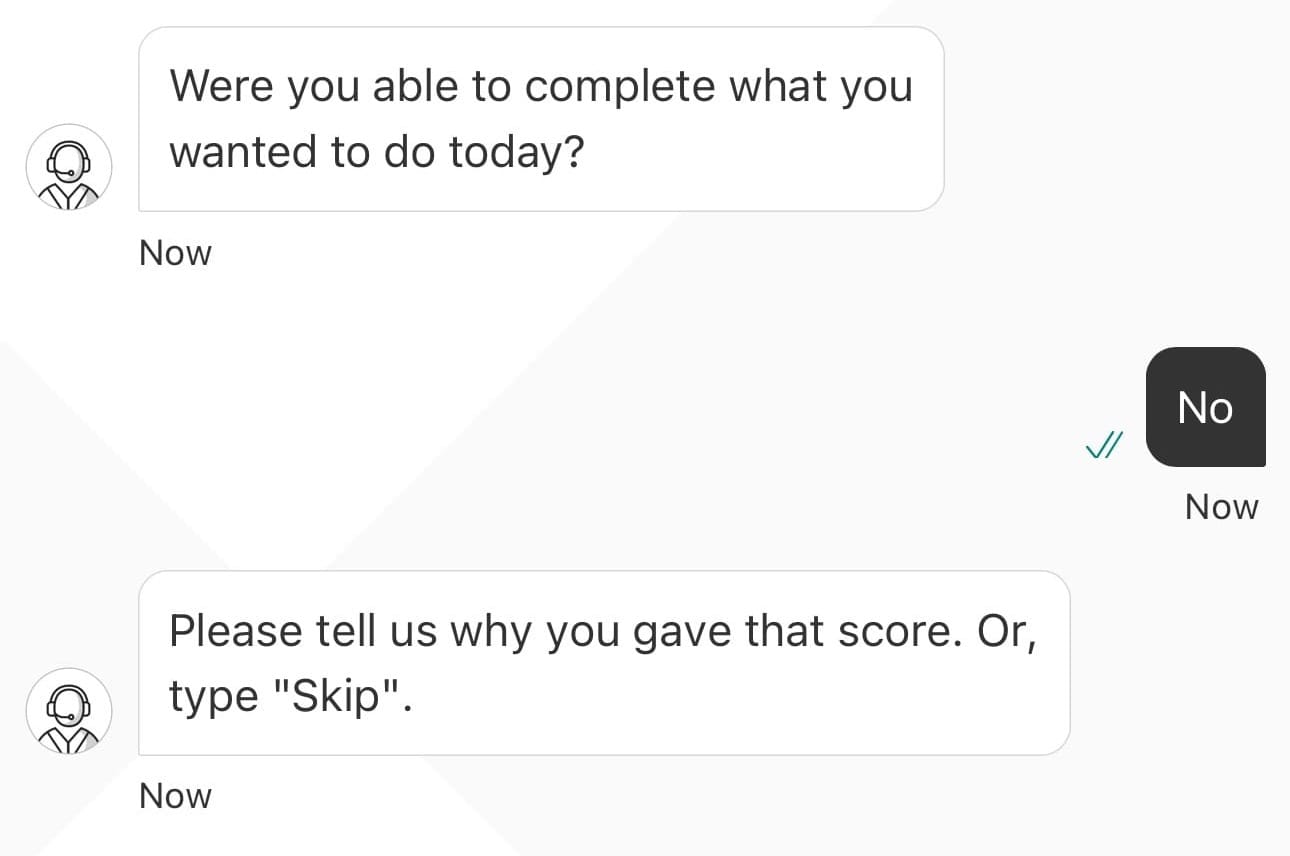

Having selected "No" (as in, I wasn't able to complete my task), MOBA then asks me why I gave this score.

This is incoherent. It looks like someone didn't programme this bit properly. MOBA shouldn't be asking my score when I've selected No.

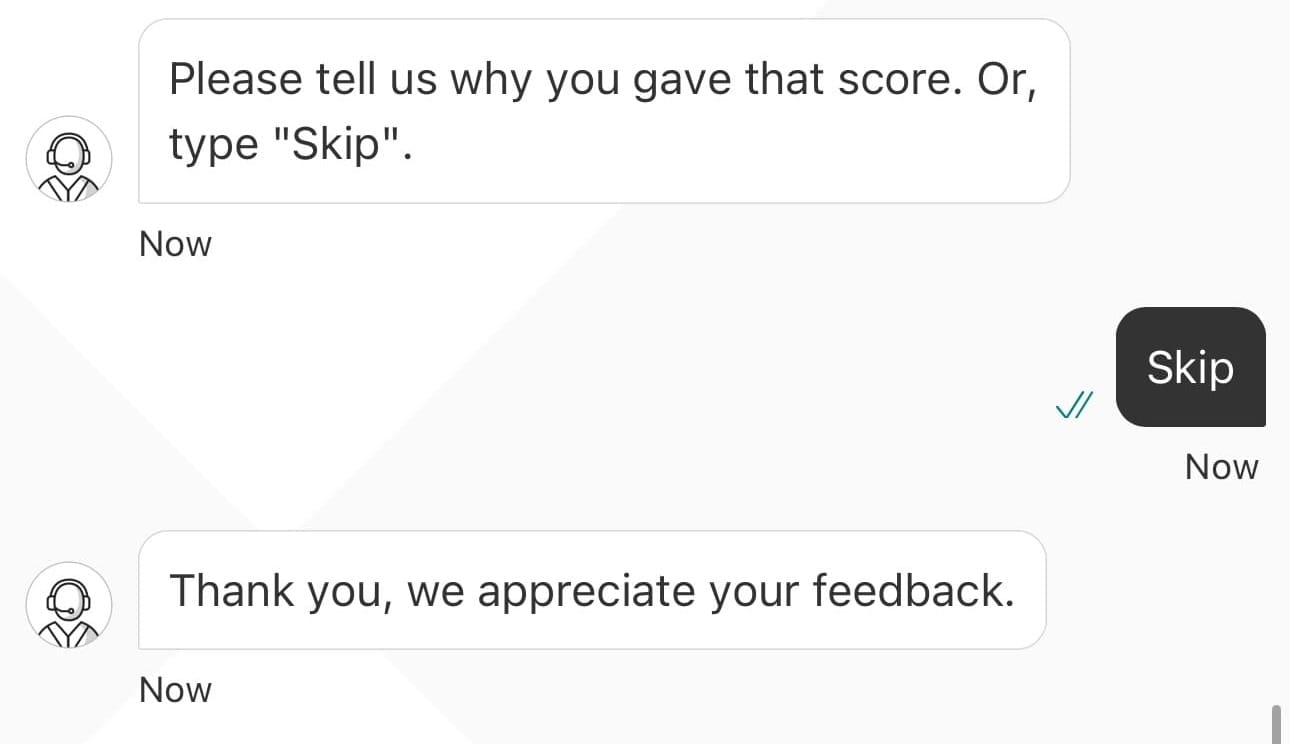

I decided to skip.

So there we go.

It worked.

I think that's the key point.

It was able to understand my request.

It sent me to a link – and I did have to do the actual work myself.

But it did work.

The key point here is that MOBA is HSBC's #1 choice for customer support. We know this because it's the top link that is suggested on the support page: "Chat with us":

I am therefore very surprised to find that HSBC UK is offering what I would consider to be a really, really good 1998 chatbot.

Sending me to a deep-link (that only takes me to the main card section) is a really poor option in today's world.

I'm expecting the Conversational AI to be able to understand my query, qualify it to be sure and then execute it.

I don't mind if you have all sorts of digital sellotape to make the whole thing work in the background. The key is my experience. Ideally, it should be a 30-second process:

- I need a new card

- Ok, why? (Or ask which card, if the customer has multiple cards)

- It's damaged (lost/stolen, etc has a slightly different journey)

- That's fine. Which card? (If the customer has multiple cards)

- Confirm with customer

- Call the various APIs / robotic process automation or whatever it needs in the background

- Tell the customer the card's on the way

In summary, I am pleased that there is a chatbot capability.

I'm also pleased that I was able to resolve my query (although, I didn't actually go through with the final replacement step as... again... my card is working fine!).

I would like to see an even better offering from HSBC soon.