Chatbot head-to-head: Lloyds vs NatWest

I recently presented at the Futurice Future FinTech event in London on the topic of Conversational AI in Banking.

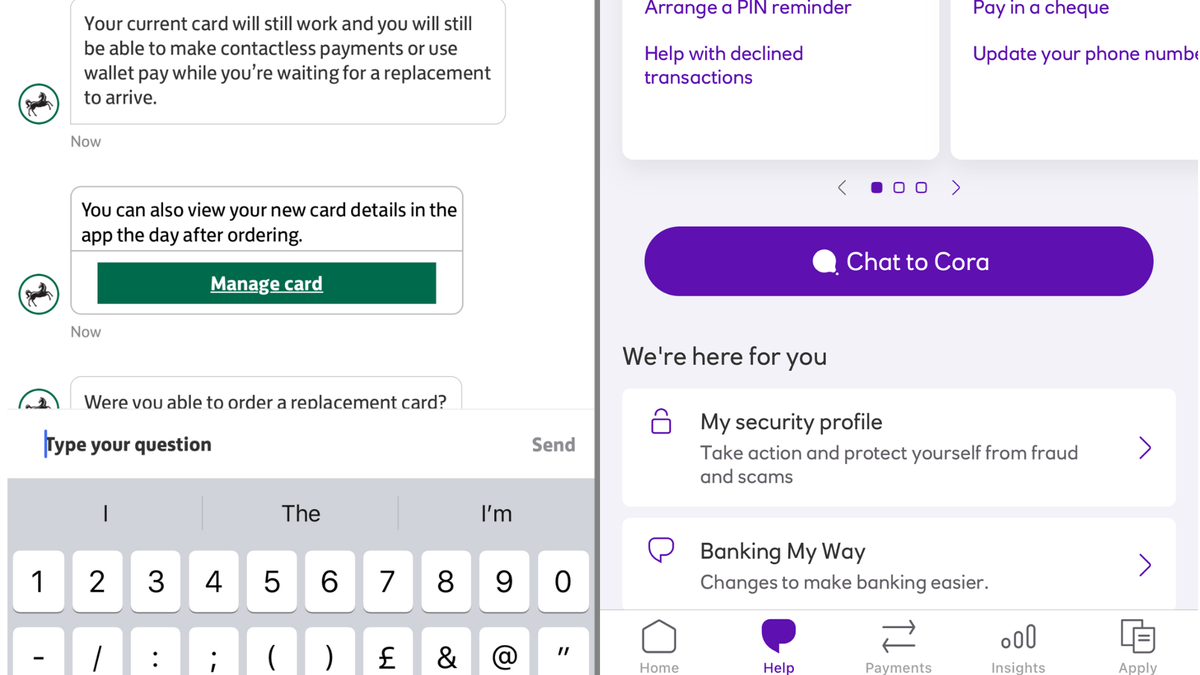

I did a screenshot walk-through of my experience using the chatbots from Lloyds Bank and NatWest Bank.

At each stage, I talked through what I was thinking and expecting as I experienced the interaction.

I picked a simple task: Damaged card replacement – this doesn't need conversations around a card being lost or stolen and the resulting potential fraud issues.

It's a boring, repetitive task that is annoying for everyone.

The customer wants it sorted right-away. The bank wants it resolved as swiftly (and cheaply) as possible. This would otherwise be a phone call tying up the call centre and preventing them from dealing with higher-value queries.

In the YouTube video below I get straight into the screenshot walk-through.

This is around 14 minutes total. The original podcast is 28 minutes - you can find that here. But that's audio only. That's ok but I would recommend you go straight to the Spotify link because that will show you the video too – so you can see the screenshots.

I'll do some more walk-throughs shortly.