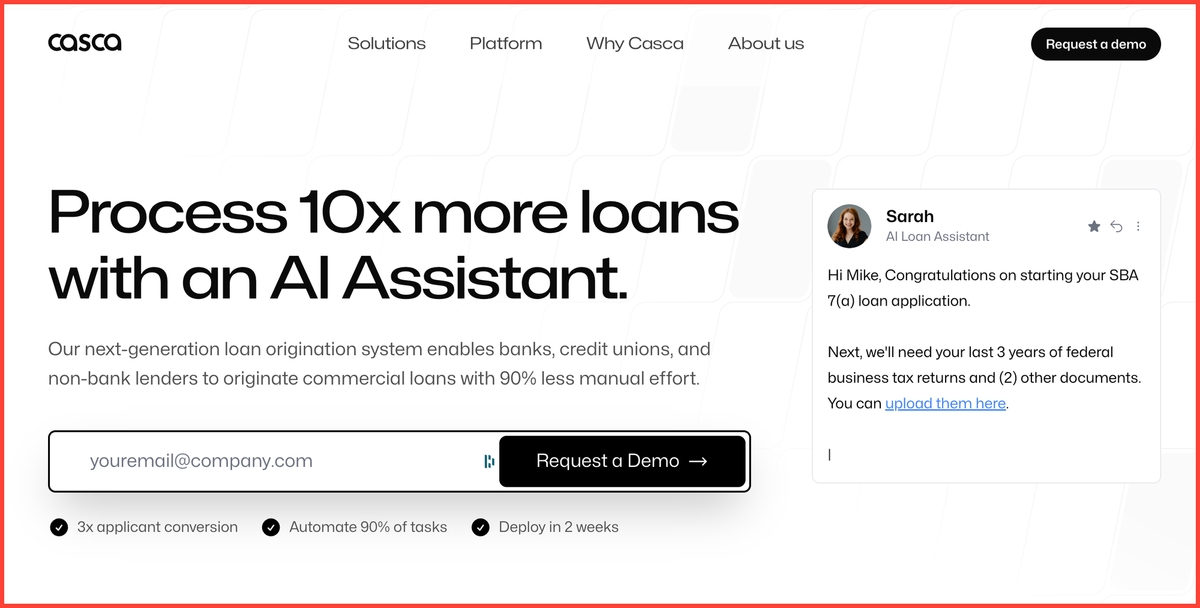

Cascading AI uses Conversational AI to 10x corporate loan origination process

I've been following Cascading AI ("Casca" for short) for the longest time.

Technically, since 2023.

But a year is a long time in the AI world, right?

I came across the Casca team thanks to their Y-Combinator batch announcement and was instantly curious. I've been following along with their progress and this week I saw that Gartner has included them in their 2024 Hype Cycle for Generative AI in Banking. This is great news for the company.

I also thought I should be bringing them to your attention if you haven't come across them before.

Their offering – using Conversational AI to manage the loan origination process for corporates – is a superb example of how the technology can help everyone concerned.

The whole process of loan origination is usually involved. There's a lot of data needed. Everything from corporate accounts, statements, proof of assets and so on.

It's even more involved when it comes to small business ("SME") loan origination because the business owners typically need a lot more hand-holding than a larger company (with their CFO and finance teams) might require.

Casca has created a series of offerings to manage the entire loan origination process. This, by itself, is great. But what really caught my attention was their deployment of Sarah, their Conversational AI engine, to help manage the whole process. Sarah manages the dialogue with the customer, asking for all of the required documents to help the customer supply the best possible picture to enable the bank's Loan Officer to make their decision swiftly.

The time savings on the part of the bank will no doubt be dramatic. But also, I think the time and efficiency savings for the SME customers will be pretty good too – because the Assistant can follow up with the customer asking for the required data.

I can imagine there will be a lot of attention from banks looking for this kind of capability.

Here's an example video of Sarah working:

Video supplied by Cascading AI

I would strongly recommend reading this American Banker (free registration) article about how Bankwell Bank in CT, USA, has implemented Casca's AI Loan Assistant (and they're also using the full Casca platform from online application to closing).

These kinds of systems can be absolutely transformational, especially for smaller financial institutions.

As an illustration, have a read of this statement from Bankwell's Chief Innovation Officer (Ryan H) about the first time they deployed Casca's AI Loan Assistant:

"The first time we sent the first message, about five weeks ago, everything changed," Haffer said. "The first person immediately responded to the message, said, Hey, I got confused. I didn't know what an EIN was. Sarah responded back, well, it is often called taxpayer identification number. You can find it in this letter." The borrower went back into the application and submitted the correct data and documents.

Seriously compelling.

Here's an example of that working:

Another video of Casca's AI Virtual Assistant working to reactive a customer

I also thought this statement from Bankwell's Ryan is highly accurate:

Sarah identifies herself as an AI assistant. "But people don't care," Haffer said. "People just have someone reaching out, giving them the information they need, giving them the link to jump back into the application. And they do."

I see this all the time with Conversational AI.

Often, executives really worry about how customers will react to 'robots'. Invariably I find that the vast majority of people simply don't care, as long as they're getting the result they need.

Very impressive Cascading AI. Good luck team. I'll be following your updates!

If you'd like to test out Cascading AI's services, I'd suggest reaching out to their CEO Lukas Haffer:

Or their Head of Marketing, Justin Norwood:

You can read more about Cascading AI on the Conversational AI Marketplace.