50% of South Africa's Capitec Bank 15M annual customer conversations are via WhatsApp

I've been following Capitec Bank's Conversational AI approach for quite a while, given their strong leadership in the domain, not just in South Africa, but globally.

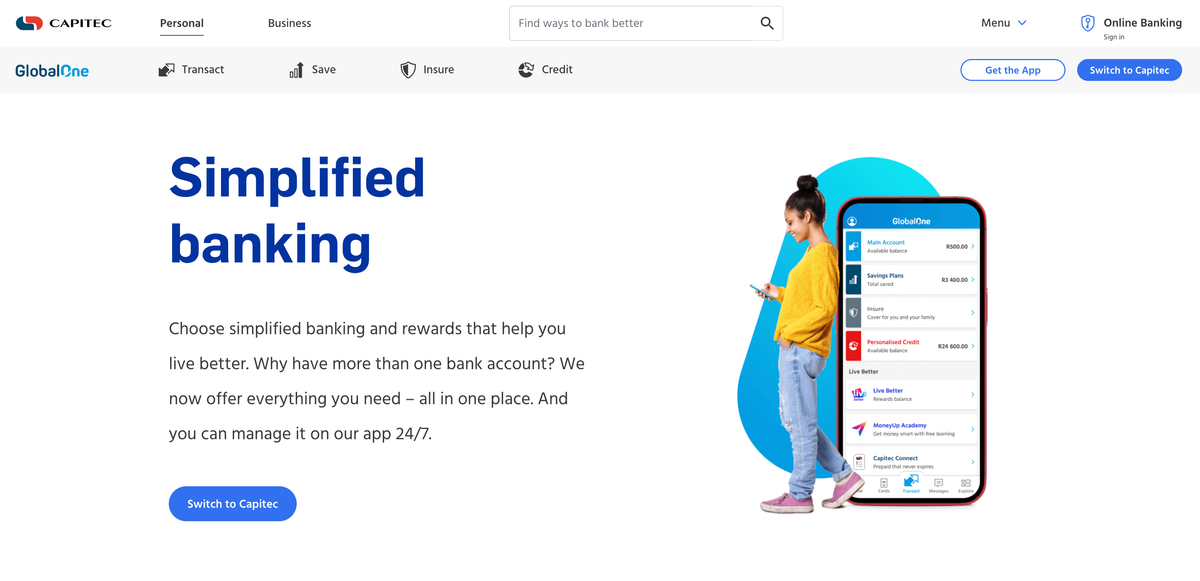

Capitec is South Africa's leading retail banks (40% of the nation banks with them) and they're very well known for their innovative approach and great customer satisfaction – all underpinned by a heavy focus on enabling technologies, like Conversational AI.

The bank's Conversational AI partner, LivePerson, helpfully published this fantastic case study giving a great overview of how the bank has adopted, leveraged and benefited from asynchronous communications capabilities.

Although the bank has 800+ branches, an increasingly digital savvy customer base were expecting a lot more – and known as a digital leader, expectations were rightly off the charts for Capitec. (By the way, kudos to Capitec for offering their own sim cards - see Capitec Connect!)

One of the key challenges for the market is that many South Africans are restricted by their mobile device storage capacities and data plans. So much so that often, it's a key choice whether to install the bank's app – or whether to prioritise the essentials such as WhatsApp.

Guess what customers prioritise? Yeah. Communication, especially when WhatsApp is essentially a business tool for so many, nowadays.

So what did the Bank do?

Well, Carlos Moodley, Head of Conversational Banking at Capitec, along with his team, sought a radically approach: Get in front of the customer, wherever they are.

And they're mostly on WhatsApp (for example).

Mention the word WhatsApp to most bankers and there's usually an involuntary shudder, simply because it's a communications channel that the "bank doesn't control". I think that is immensely outdated thinking and it's a constant irritation to me that I can't control all my financial services needs through WhatsApp or whatever channel I'm prioritising. But, if your customer is literally uninstalling your app because they need to be using WhatsApp, then get on that channel. Get in front of the customer!

Here's Carlos talking about the bank's philosophy:

“Through conversational banking, we are bringing our vision to life of becoming a trusted financial partner to our clients. By meeting them in their preferred channels and engaging on their terms, we are not only simplifying their banking experience but also fostering meaningful relationships. Our commitment to consistently delivering superior client experiences strengthens trust, builds loyalty, and positions Capitec as an integral part of our clients’ financial journeys.”

It's far, far more personal – and relevant – to be popping into a customer's WhatsApp feed. This is what most banks don't recognise. Capitec did. But, you have to treat that opportunity with respect – and you need to make sure you're offering the very best services as a result.

Further, as you're scaling to millions of customers digitally, you can't be constantly doing what most banks do and 'defaulting to branch' for anything complicated.

No, you need to re-architect your processes and services so that they can be consumed asynchronously and through the likes of WhatsApp.

So that means you're interacting with customers conversationally by default.

And you need a vendor partner and technology stack that can cope – so you can integrate across as many of your core banking capabilities as possible, so that customers can get stuff done without having to visit a branch or speak to a human.

That's where LivePerson comes in.

Capitec Bank made use of a whole set of LivePerson's capabilities including the basic Conversational AI capability, along with WhatsApp integration, Agent Assist – and, crucially, Generative Insights to help analyse what customers are saying and doing.

Here are some of the metrics from the case study:

71% first contact resolution is really, really good. Also: Note that half the bank's conversations are taking place via WhatsApp!

Nice work Capitec. Nice work LivePerson!

If you're curious about how Capitec Bank approaches Conversational AI, I would a) strongly recommend reading the LivePerson case study (PDF download here) and b) follow the bank's Conversational AI expert Carlos Moodley on LinkedIn for more public updates as they come.